VinaCapital

Vietnam Opportunity Fund

Investing in the best public and private companies in Vietnam

Vietnam is one of the fastest growing economies in the world, applying the East Asian Economic Model that has been successfully used by other countries in the region to modernise and transform their economies to become developed nations. VOF invests in listed and privately held companies benefiting from Vietnam’s structural growth regardless of sector.

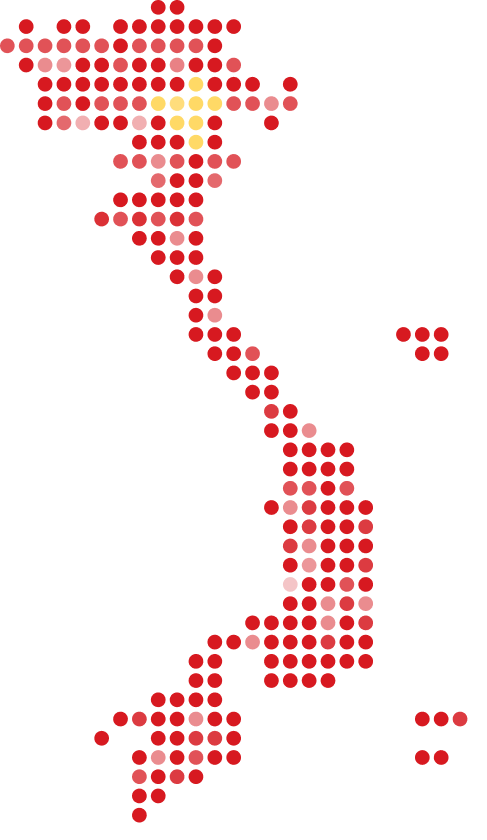

HaNoi

(Capital)

HaiPhong

DaNang

Ho Chi Minh City

Why vietnam

8-10%

2025-2030 GDP Growth

After a decade of strong GDP growth (6% on average), Vietnam is further propelling growth through domestic reforms with focus on the private sector.

Why VOF

Asia Commercial Bank

Why vietnam

100 million

Population

A young nation with median age of 33 y.o. and a fast-growing middle class (USD4,700 GDP per capita). Domestic consumption is a key contributor to economic growth.

Why VOF

Phu Nhuan Jewelry

Why vietnam

~40%

Urbanization rate

Vietnam aims to reach 50% by 2030 as urban migration continues, driven by FDI inflows, industrialization and overall economic growth.

Why VOF

Vinhomes

Why vietnam

~7% of GDP

Infrastructure spending

Highest GDP spend on infrastructure in the region with focus on key infrastructures like highways, airports, seaports to support economic growth.

Why VOF

Hoa Phat Group

Fund Information

Delivering long-term performance

Net Asset Value

£759.8mn

NAV Total Returns

12.7%

NAV per Share

£6.05

Share Price

£4.68

Net Asset Value

$1,034.9mn

NAV Total Returns

11.3%

NAV per Share

$8.24

Share Price

$6.55

As of 13 Feb 2026

Fund Facts

Launch Date

2003

Listing

London Stock Exchange (LSE)

Ticker

LON: VOF

Bloomberg

VOF:LN Equity

ISIN

GG00BYXVT888

Asset Class

Vietnam Equities (Private & Listed)

Trading Currency

GBP

Latest News and Insights

Stay updated with VinaCapital

Up next

Receive Updates:

Video Updates

Macro Reports

Latest News

Insights