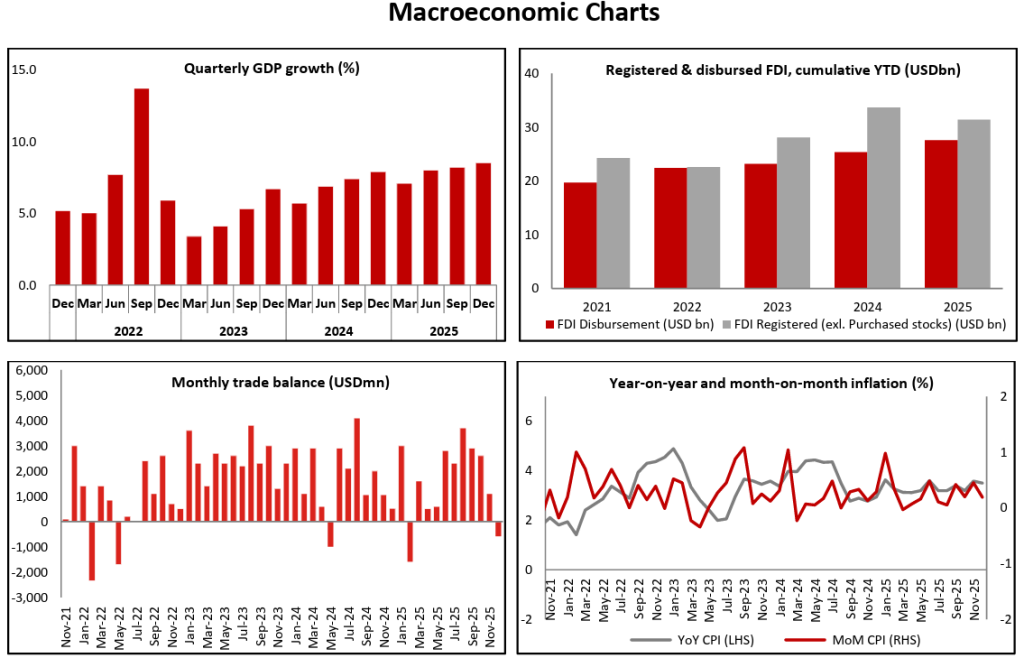

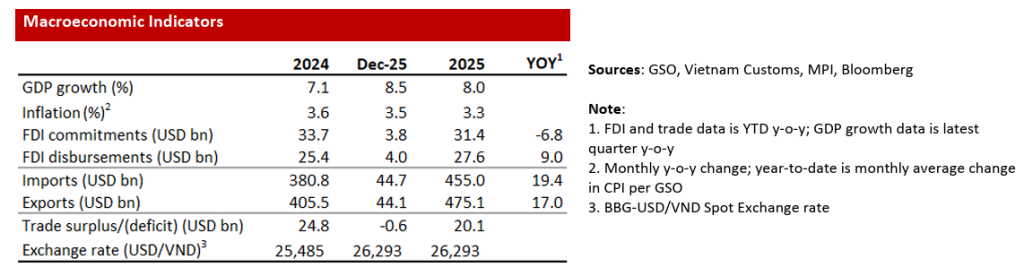

GDP Accelerated. Vietnam’s GDP growth accelerated from 7.1% in 2024 to 8% in 2025. Several factors supported the country’s growth last year, the two most notable of which were a 40% increase in Chinese tourist arrivals (Vietnam replaced Thailand as the most favored destination for Chinese tourists according to the South China Morning Post) and a 28% surge in exports to the U.S. (driven by an 80% jump in exports of laptops and other electronics products).

Tariffs Shrugged Off. Vietnam’s exports to the U.S. essentially shrugged off Trump’s tariffs, partly because the initial 46% “reciprocal tariff” that was announced on April 2 (“Liberation Day”) was quickly reduced to 20% and with exemptions for key categories like electronics; the effective rate is now trending toward 10%. Brian Moynihan, the CEO of Bank of America, recently commented that he expects further tariff de-escalation in 2026 as reported by Bloomberg.

Exports Surged. The net result of all the above is that Vietnam’s export growth accelerated from 14% in 2024 to 17% in 2025, and Vietnam achieved a USD 20b trade surplus, equivalent to about 4% of GDP. This marked the tenth consecutive year that Vietnam has maintained a trade surplus and the third consecutive year in which the surplus was USD 20 billion or more. Most products manufactured in Vietnam are exported, so strong export growth translated into 10% growth of the manufacturing sector and 6-7% factory wage growth. Recall that manufacturing accounts for one-third of Vietnam’s GDP.

Domestic Consumption Weak. That said, we estimate that spending by Vietnamese consumers only grew by about 5% last year (versus 8-9% pre-COVID) when the spending of foreign tourism is stripped out. That weak pace of domestic consumption growth stemmed from the fact that the household savings rate in Vietnam has remained elevated post-pandemic as households continue to rebuild their savings, which were depleted during COVID.

Tourism Lifted Retail Sales. Real retail sales growth (i.e., stripping out inflation) grew by about 6.7% last year, but tourist arrivals, driven by the increase in Chinese visitors, rose 20%; we estimate that foreign tourists account for roughly 10% of retail sales. The net result is that domestic consumer spending grew by about 5% in 2025 after stripping out foreign tourists. The Government has taken some modest measures to support consumption growth, including trimming both VAT and personal taxes, but the direct impact of those measures is likely less than 0.5%pts/GDP, and we believe the Government could do much more to simulate growth if need be.

Inflation Contained. The silver lining to the weak consumer story is that muted consumer sentiment combined with outright weak sentiment in China put a lid on inflation in Vietnam. Inflation averaged 3.3% in 2025, which is well below the Government’s official 5% maximum inflation target.

Dong Depreciation Contained. The USD-VND exchange rate depreciated by about 3% in 2025, which is consistent with an apparent (though not explicitly stated) maximum depreciation target. The VN Dong had depreciated by more than 3% in late-2025, driven by a few factors including a 70% surge in gold prices. The State Bank of Vietnam responded to the weakening of the Dong by allowing interest rates to drift higher, which helped stem depreciation pressures. Twelve-month bank deposit rates increased by about 50-100 bps in 2025 to around 6% on average by year-end; rates typically need to go above the 7% level to meaningfully impact/damage stock market performance.