Vietnam’s Growth Accelerates: Exports, FDI, and Tourism Fuel 2025 Surge

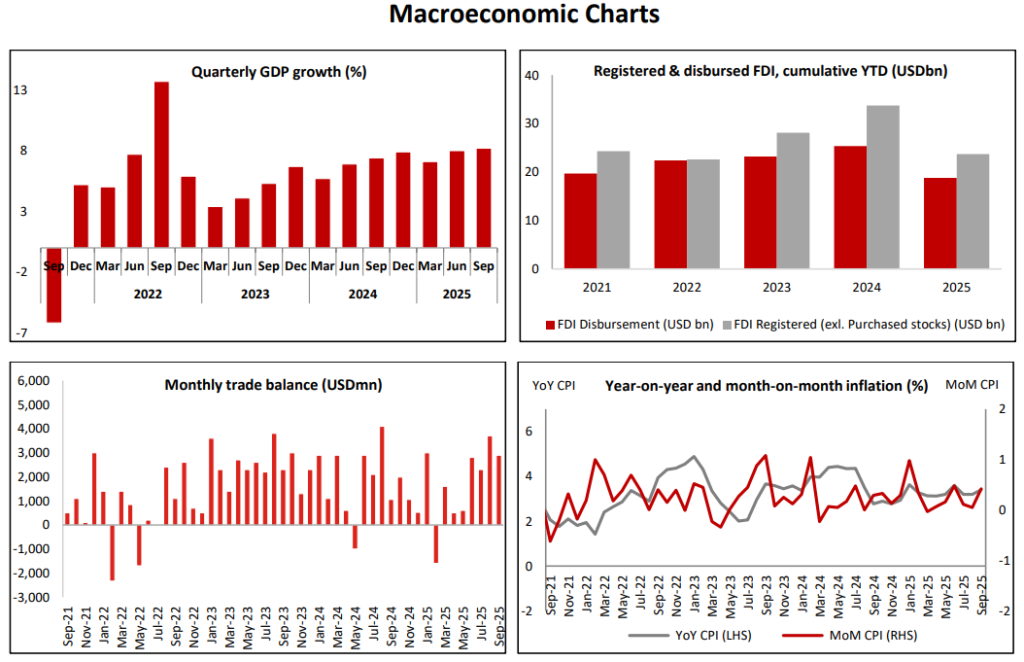

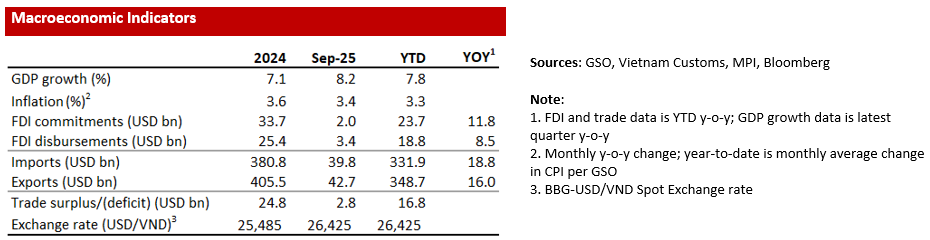

Growth Accelerating. Vietnam’s economic growth accelerated from 7.6% YoY in 1H25 to 7.9% in 9M25, supported

by unexpectedly strong exports to the US, prompting us and most other economists in Vietnam to lift our 2025

GDP growth forecasts. We now expect GDP growth to reach 7.5% in 2025 thanks to an incredible surge in computer

and electronics exports (up nearly 50% this year despite an already large base), and because of a boost in

Government infrastructure spending that has yet to trickle down into the “real economy”.

Exports stable. Regarding the former, there has been almost no drop off in Vietnam’s exports to the US after

Trump’s tariffs came into effect (i.e., after the “front loading” surge in exports from Asia to the US had passed).

Furthermore, new export orders have nearly stabilized after having plunged to very low levels during the summer.

Apple’s recent decision to shift more production of MacBook computers and other Apple products sold in the US

from China to Vietnam is one factor supporting Vietnam’s exports and FDI inflows.

FDI stable. That decision, which was discussed in a recent Bloomberg article, helps explain why planned FDI in

Vietnam are up 12% YoY to 7%/GDP in 9M25 – an impressive figure, which is even more impressive in light of

Trump’s tariffs. Vietnam will remain the low-cost producer of high-tech products to the US as long the difference

between the tariffs on Vietnam’s exports and those of its peers are less than 10% pts.

Infrastructure Spending Up. Next, infrastructure spending is up 43% YoY in 9M to USD16.7b (5%/GDP), according

to an initial estimate from the Ministry of Finance, but the growth of construction activity (which includes both real

estate and infrastructure construction) is up only 8.5% YoY despite the Government’s current focus on “shovel

ready” projects. The big divergence between these two growth figures reflects the latency between the time that

Government funds are earmarked/disbursed and the time that actual infrastructure construction work

commences.

Strong leadership driving reforms. There is a clear urgency to push projects forward to boost the economy,

especially in the lead-up to the next Communist Party of Vietnam (CPV) National Congress next year. And the

Government has been taking steps to speed up the project approvals process as part of its broader reforms to

streamline its own operations (we believe these reforms will boost Vietnam’s long-term GDP growth potential by

more than 1%pts).

Boost to GDP growth in 2026. However, large infrastructure projects typically entail land acquisition, planning,

permitting and procurement of construction materials – all of which takes time – so we expect construction activity

to accelerate to double-digit growth in Q4 and into 2026. The delayed impact of the Government’s infrastructure

investment, coupled with the general lift to the economy from the “Doi Moi 2.0” reforms (which we discussed

here), should boost Vietnam’s GDP growth next year.

Consumption growth picking up. We also expect a modest pick-up in consumption growth next year to support

GDP growth. Consumer sentiment in Vietnam bottomed out around the middle of last year and improved gradually

up until Q1 25 but subsequently flattened out for most of this year. Real retail sales (i.e., stripping out the impact

of inflation) is stuck at around 7% YoY (7.2% YoY in 9M25), but that 7% growth figure has been (fortuitously)

boosted by a ~20% surge in tourist arrivals thanks to a resumption of Chinese tourism.

Consumer savings rebuilt. Local consumer spending is only growing at around a 5% YoY pace when the boost from

tourism is stripped out compared to 8-9% pre-COVD growth. This is further reflected in mediocre revenue growth

of many companies selling to local consumers. In short, consumers depleted their savings during COVID and have

been subsequently rebuilding their savings at an elevated rate. This phenomenon was first identified last year by

InFocus Mekong Research via their surveys of local consumer sentiment, and we estimate that the savings rate in

Vietnam has been about 10% pts above normal rates since that time. If our estimates are correct, then consumers will have rebuilt enough of their savings rates to start resuming typical levels of consumption growth again by mid2026, which is another reason we expect strong GDP growth in 2026.