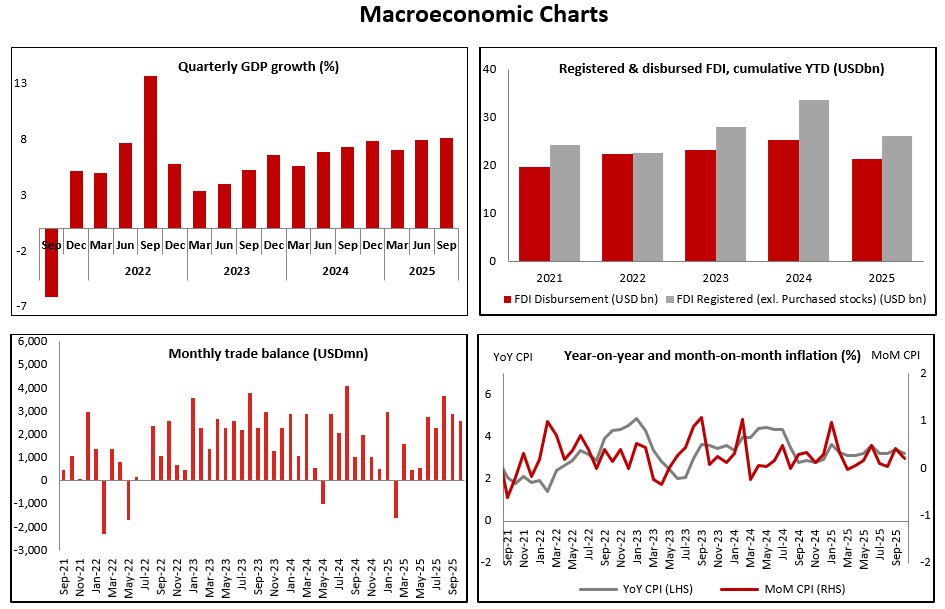

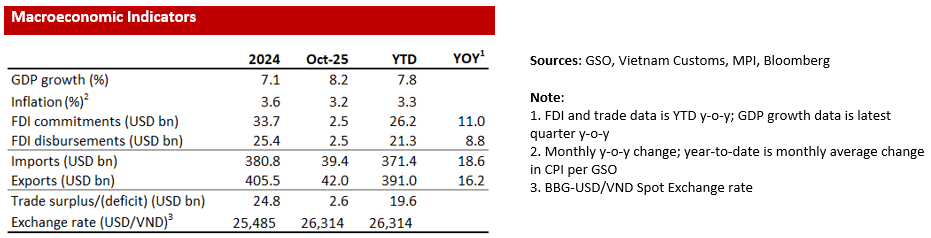

Vietnam’s economic growth in 2025 has been driven by two main factors, which remained strong in October: robust

exports to the US—especially high-tech products—and a steady increase in tourist arrivals from China. Exports to

the US rose by nearly 30% in the first ten months of 2025, while tourist arrivals were up 22%. Both figures were

essentially unchanged compared to the previous month.

Exports of laptop computers and other high-tech products (excluding smartphones) surged nearly 50% in 10M25

(unchanged from 9M25). This incredible performance is being supported by both AI-linked demand and by the

continued opening of new factories producing high-tech products in Vietnam. In last month’s economic

commentary, we discussed Apple’s shift of more MacBook production to Vietnam. In October, it was announced

that Intel will further increase its production in the country.

We expect further resilience in the months ahead, reflected by the return of the “New Export Orders” sub-index

of the PMI into expansionary territory for the first time in a year. That sub-index bottomed out at the abnormally

low level of 43.4 in June and has been recovering since then, reaching 51.1 in October. New export order recovery

drove Vietnam’s headline PMI up from 50.4 in September to 54.0 in October.

In addition to strong demand for IT products, Vietnam’s unexpected export resilience is also partly attributable to

the relative tariff rate on Vietnam’s exports versus its regional competitors that also export to the US. In July,

President Trump announced a 20% “reciprocal” tariff on Vietnam, which is comparable to or lower than the tariff

rates of countries like India and Thailand. As long as the spread between the tariffs on Vietnam’s exports to the

US and its competitors is less than 10% pts, Vietnam’s exports and FDI inflows (which were up 9% in 10M25) are

unlikely to be significantly affected.

In October, there were further developments on the tariff front. The US made firmer commitments to exempt

more products for lower preferential rates, although the details of these exemptions have not yet been publicized.

Long story short, we believe the actual effective tariff rate on Vietnam’s exports to the US will be below 15% starting

at some point within 2026.

In contrast to very strong exports, the consumption picture for local Vietnamese consumers weakened a bit further

in October due to severe weather conditions and flooding. Real retail sales (i.e., excluding inflation) dipped from

7.2% year-on-year in 9M25 to 7% in 10M25. Stripping out the 22% surge in tourist arrivals, spending by local

domestic consumers is probably growing at less than 5% year-on-year this year.

The one saving grace of tepid domestic consumption growth is that inflation is well under control. In fact, it dipped

from 3.4% year-on-year in September to 3% in October. China’s weak domestic consumption was another factor

that helped keep food price inflation and overall inflation low in Vietnam in October.