Growth Story Remains Strong Despite Interim Issues

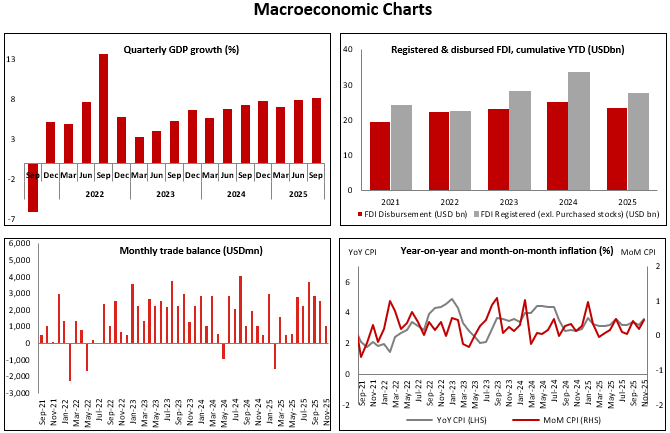

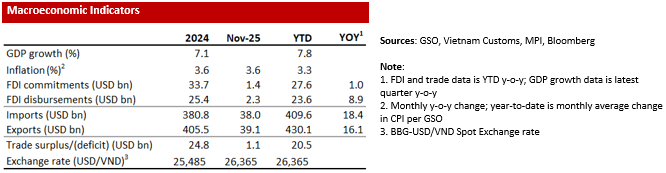

Flood Impact Limited. In early November, severe floods in Vietnam attracted international news coverage and prompted fears that the resulting damage might derail the country’s GDP growth. However, while the flooded area covered about a quarter of Vietnam’s geographic territory, the affected areas represented less than 10% of the country’s population and GDP. Consequently, estimates of the economic impact based on Government damage reports suggest it will be relatively minor, likely under 0.3% of GDP, and we continue to expect 7.5% GDP growth for the full year.

Brief Disruption. The floods did cause a small dip in both manufacturing output and retail sales in November. Manufacturing had been increasing, and although consumption was relatively flat for several months, both were poised to accelerate in the months ahead. The floods briefly interrupted this, but the overall outlook remains positive, and we continue to expect 8% GDP growth next year, which we discussed in our investor conference presentation. Note also that we will also discuss the stock market implications of our economic outlook in our upcoming “Looking Ahead at 2026” report.

Manufacturing Strong. Manufacturing output in Vietnam grew 10.6% YoY in the first eleven months of 2025 (11M25), driven by a surge in high-tech product exports excluding smartphones (i.e., laptops and other electronics products) by nearly 50% this year. Exports to the U.S. alone were up 27% YoY in 11M25, and there are two strong leading indicators that suggest this manufacturing momentum will continue in the months ahead: 1) the new export orders sub-index of the PMI, which climbed to a 15-month high of 52.4 in November, and 2) imports outpaced exports in 11M25 (18.4% YoY import growth versus 16.1% export growth).

Trade Surplus Growing. Import growth is being driven by FDI companies bringing in production materials, which is another sign that export and manufacturing strength will persist in the coming months. The net result of all of the above is that Vietnam’s trade surplus reached USD 20.5 billion for the first eleven months of 2025, about 4.8% of GDP, and the surplus with the U.S. reached USD 122 billion, or 29% of Vietnam’s GDP.

Consumption Softened. The floods had more of an impact on domestic consumption. Real retail sales growth (i.e., excluding inflation) dipped from 7% year-on-year in the first ten months of 2025 (10M25) to 6.8% in 11M25, although retail sales in Vietnam continued to be supported by the ongoing surge in tourist arrivals, which rose more than 20% YoY. Another negative impact of the floods was an uptick of Vietnam’s CPI inflation rate, from 3.3% YoY in October to 3.6% in November, driven by a 1% month-on-month increase in food prices—particularly vegetables—due to flood-related supply disruptions.

Interest Rates Up. Interest rates at the country’s commercial banks rose by about 50 bps in November (for both 12-month deposit rates and for interbank overnight rates), but this increase was more about tight liquidity in the banking system than flood-driven inflation. Credit growth as of 21 November was over 16% YTD, significantly outpacing deposit growth of 12% over the same period; a difference of more than 200-300 bps between deposit growth and credit growth in Vietnam usually pushes deposit rates higher. In addition, liquidity is typically tight going into the calendar year-end as banks work towards achieving their statutory liquidity ratios.

Markets Resilient. The resulting increase in interest rates was notable, but not enough to derail the stock market or real estate market. Deposit rates among commercial banks in Vietnam usually vary considerably, but rates currently average around 6% and would need to increase by at least another 100 bps to prompt savers to take their money out of the stock market and put it into long-term bank deposits.