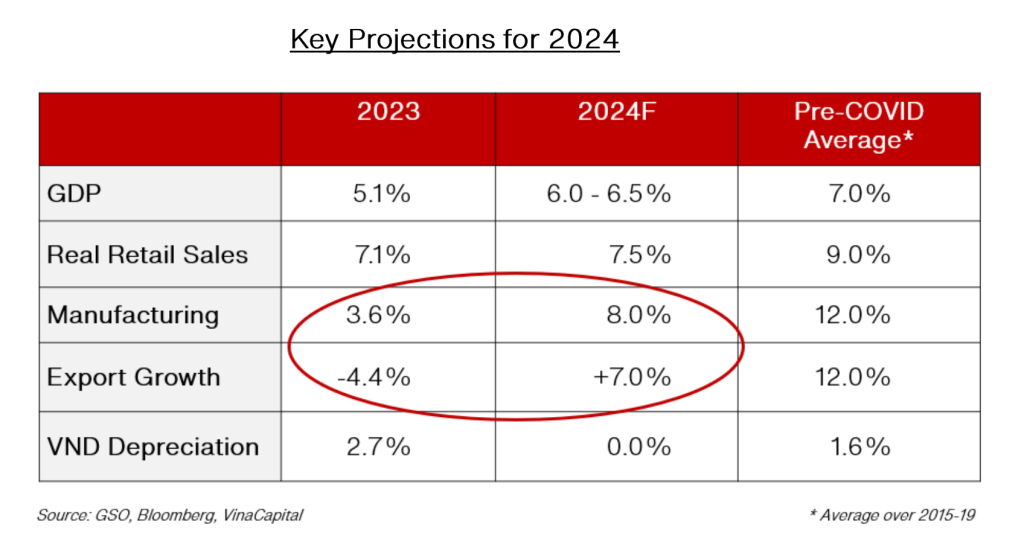

After a challenging 2023, all indications are that 2024 should be a stronger year for Vietnam’s economy, driven by a rebound in the manufacturing sector and an improvement in consumer sentiment. In addition, the plunge in interest rates throughout 2023 should help boost the real estate market after having helped support the stock market last year. In 2024, we expect:

- GDP growth to increase from 5.1% last year to 6-6.5% this year driven by a recovery in Vietnam’s exports, which fell 4% in 2023, to 7% growth in 2024. The demand for “Made in Vietnam” products – especially for consumer electronics – from consumers in the US/EU has already started to recover and is likely to accelerate as 2024 progresses.

- Domestic consumption growth to recover. Consumption by local Vietnamese (excluding tourists) was nearly flat last year, partly because sentiment was depressed by layoffs in the manufacturing sector and issues in the real estate market, but consumption already started recovering in late-2023 as factories began rehiring workers and the Government took steps to address issues in the real estate market.

- The VN-Index (VNI) earnings to increase 10-15%, driven by 18% earnings growth in the Banking sector (which has a 37% weighting in the VNI) and by 33% earnings growth in the Consumer sector (14% weighting), both of which reflect our expectations for faster growth in domestic consumption, and faster credit growth this year.

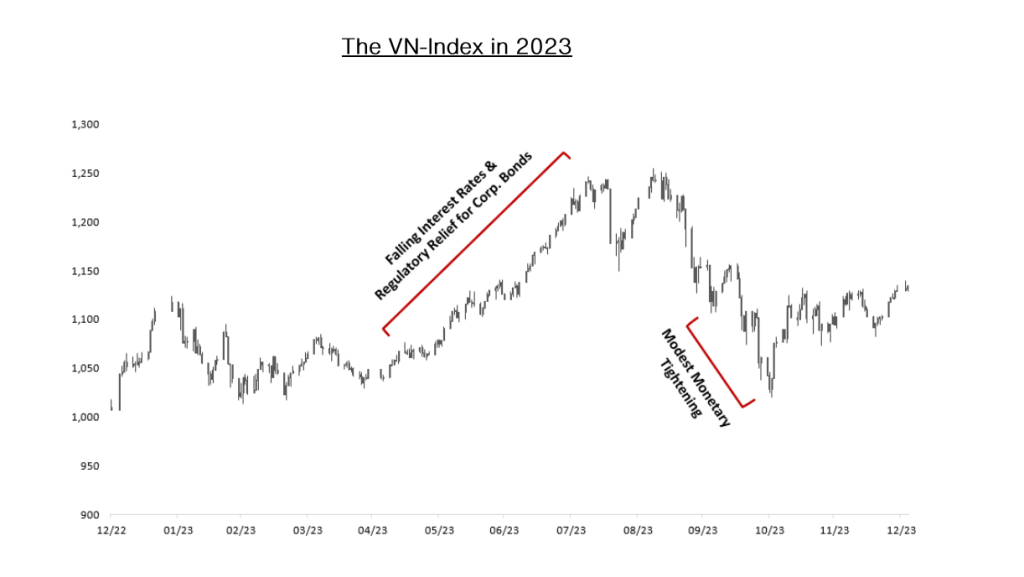

Further to that last point, the VNI ended 2023 up 12.2% (and up 9.3% in USD terms) after having been up as much as 24% YTD in early-September before USD-VND depreciation prompted the State Bank of Vietnam (SBV) to tighten monetary policy somewhat – which sent stock prices tumbling. However, the value of the VND is likely to be fairly stable this year as pressures on Vietnam’s currency are more balanced now than in 2022-23.

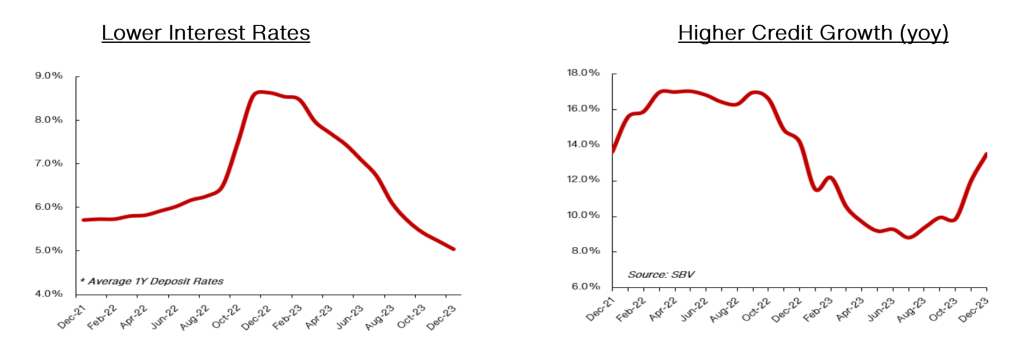

A stable USD-VND exchange rate means that interest rates will also remain stable, since most of the 2022-23 fluctuations in VND interest rates was linked to the USD-VND exchange rate. Lower interest rates and lower interest rate volatility help support Vietnam’s economic growth via credit creation, making loans more accessible and affordable to businesses, prospective home buyers, and consumers.

Finally, Vietnam’s position in the world’s evolving geopolitical landscape, coupled with the country’s existing appeals to investors helped propel a 32% increase in registered FDI last year to USD 37 billion (9%/GDP) despite concerns about the recent implementation of the Global Minimum Tax (GMT) regime, which is discussed below. Vietnam was the only country that both Joe Biden and Xi Jinping visited in 2023, prompting the Wall Street Journal to publish an article titled “Why Everyone Wants to be Vietnam’s Friend”.

Vietnam’s GDP Growth to Accelerate in 2024

We expect Vietnam’s GDP growth to reach 6.5% in 2024 due to several factors, including:

- Manufacturing output growth is likely to recover from less than 4% in 2023 to 8-9% in 2024, which is still below pre-COVID growth levels because of the weakening US/global economy (most products manufactured in Vietnam are exported, especially to the US).

- Interest rates in Vietnam will likely remain lower and less volatile than over the last two years, which will support the economy in a number of ways, including encouraging consumption and credit growth.

- Consumption is likely to see a modest acceleration, supported by #1 and # 2 above, although real retail sales growth is only likely to accelerate slightly in 2024, and most likely later in the year.

Further to that last point, Vietnam’s GDP growth fell from 8% during its post-COVID reopening boom in 2022 to 5.1% last year, a drop that was roughly equally attributable to plunges in industrial production/manufacturing and in the services sector/domestic consumption. While we expect a healthy rebound in manufacturing activity, we do not expect a big increase in the growth of consumption. That’s because a surge in foreign tourist arrivals last year boosted consumption last year – which will not be repeated this year.

The number of tourists visiting Vietnam from countries other than China (which previously accounted for about one-third of total tourist arrivals) has almost fully recovered to pre-COVID levels. There is a possibility that Chinese tourist arrivals (which only reached 30% of pre-COVID levels last year) will continue to recover in 2024, but consumer sentiment in China currently languishes at similar levels as during the country’s COVID lockdowns as the country deals with a wide range of structural economic issues.

The main risk to our moderately positive outlook is the possibility of a “hard landing” in the US economy, causing demand for “Made in Vietnam” products to plunge. The value of the US Dollar would likely soar in such a scenario (as it typically does) driven by “safe haven” buying, which would limit the ability of Vietnamese policy makers to respond to a slowing Vietnamese economy by slashing VND interest rates (Vietnamese policy makers have repeatedly shown their resolve to defend the value of the VN Dong in recent years).

That said, the Vietnamese Government would have ample ability to respond to such a crisis with massive fiscal stimulus, including a surge in infrastructure spending. In early 2023, the Government guided its intention to increase infrastructure spending by about 50% to about USD 30 billion, or 7%/GDP last year, up from 4%/GDP in 2022. It is very likely that part of the reason the Government intended to ramp up infrastructure was to offset the predictable hit to the economy from the slowing global demand for “Made in Vietnam” products.

Early indications are that infrastructure spending increased to around USD 25 billion (or to 6% of 2023 GDP), and that the Government plans a similar level (USD 25b) of spending this year. Critically, the Government’s past prudence permits it to significantly ramp up spending if it wanted to. The State Treasury of Vietnam reportedly has over USD 30 billion of undisbursed funds deposited in the country’s banks¹ – most of which was earmarked for infrastructure projects in past years but did not get spent – and the Government debt-to-GDP ratio is below 40%, which is very low compared to most EM and DM countries around the world.

Finally, the Government implemented a few minor measures to boost the economy last year, including a temporary cut in the country’s VAT rate from 10% to 8% and a cut in the environmental tax on petrol; these measures probably only equated to total of about 0.5% of GDP, although a planned increase in public sector salaries next year will probably equate to another circa 1%/GDP of stimulus to the economy. All of that said, we again believe the Government could do much more to support the economy if it needed to.

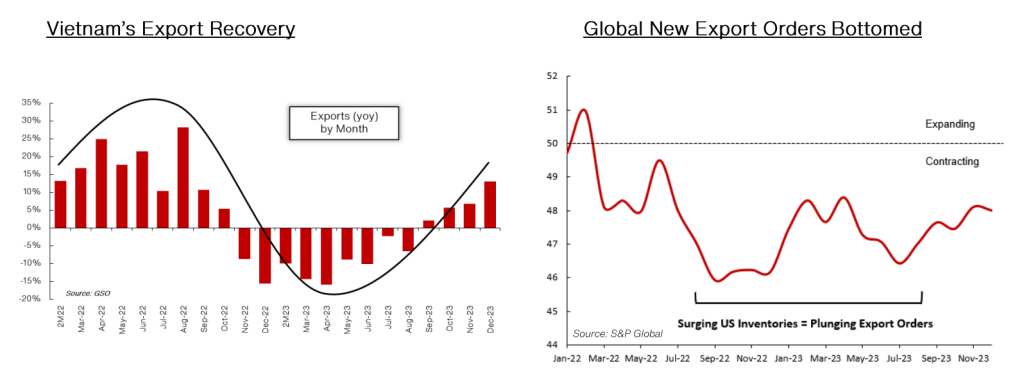

Vietnam’s Exports and Manufacturing Are Rebounding

In 2023, a plunge in Vietnam’s manufacturing output and exports were the biggest drags on the economy, just as we predicted in our “Looking Ahead at 2023” report, which was a non-consensus call at that time. However, Vietnam’s longest streak of falling exports in over a decade has already bottomed out and export growth is likely to accelerate to some degree throughout 2024.

Global export orders are poised to start expanding again because the inventories of US retailers and other consumer facing firms look likely to end 2023 down about 5-7% year-on-year, according to recent earnings calls of firms like Walmart, Target, Best Buy, Nike and others. Inventories of US retailers had surged by well over 20% yoy in late-2022 and the resulting destocking efforts is reflected in the plunge in global export orders that can be seen in the chart below.

Inventory depletion in 2023 explains why Vietnam’s overall exports deteriorated from 11% growth in 2022 to a 4% drop in 2023. With exports equating to over 80% of GDP, a swing of that magnitude has a major impact on GDP growth. We only expect a modest rebound in exports to the US this year, partly because US credit card debt surged ~40% over the last two years, which is constraining US consumers’ capabilities to continue purchasing “Made in Vietnam” products and which helps explains why 2023 holiday spending in the US was reportedly tepid².

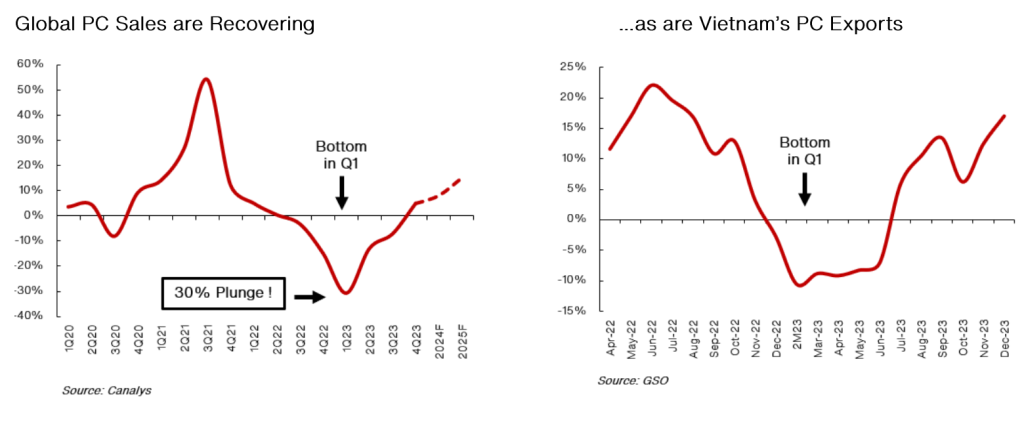

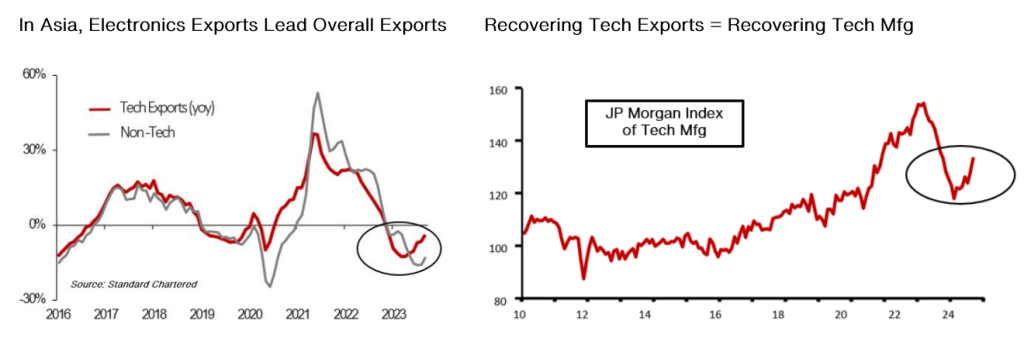

Electronics Exports Already Rebounding

Computers and electronics exports are already rebounding, although exports of smartphones and low value garment products are still falling (note that each of those three product categories accounted for about 15% of Vietnam’s total exports last year). Sales of PCs and other “work from home” products plunged post-COVID, but users have started upgrading to computers that are sufficiently powerful to run AI applications.³ This helps explain why market research firm Canalys expects global PC sales to rebound from a 12% drop in 2023 to nearly 10% growth in 2024.

In contrast, global smartphone sales are only likely to improve from a 3.5% drop in 2023 to 3.8% growth in 2024 according to IDC. Smartphone sales resumed growing for the first time in two years in late-2023 (by about 5% year-on-year), but unlike PCs, for which there is a compelling reason for users to upgrade, consumers do not see sufficiently compelling reasons to upgrade their smartphones.

The net result of all of the above is that “the tech sector has bottomed out…led by consumer electronics replacement demand” as Standard Chartered noted in its 2024 global strategy report. Standard Chartered also observed that electronics exports tend to lead overall export recovery/growth in Asia, which bodes well for Vietnam’s overall exports in 2024, while JP Morgan’s 2024 strategy report highlighted the resulting rebound in Asia-wide tech manufacturing output, which bodes well for GDP growth.

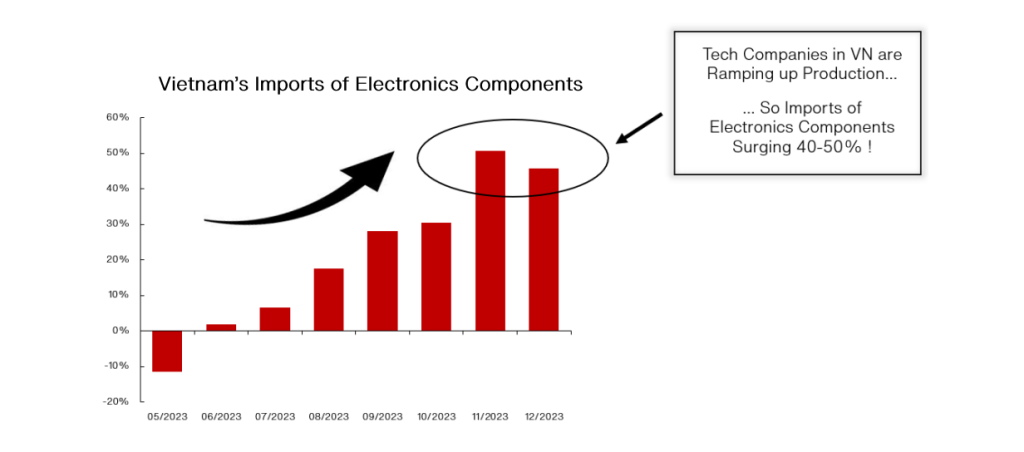

Additionally, we note that Vietnam’s imports of the electronic components used to manufacture computers and consumer electronics is surging, which is a reliable leading indicator that companies are ramping up to fulfil the orders in their pipelines.

Finally, garment and footwear exports have not started recovering yet because: 1) demand from US consumers remains weak (Target’s CEO noted that some US consumers put off buying winter clothes last year until the weather actually turned cold); 2) some production is relocating to countries with cheaper wages (especially Bangladesh); and 3) some production is moving out of Asia entirely to minimize the possibility that any of the cotton or other raw material inputs were sourced from China.

All of that said, the overseas customers of garment and footwear factories in Vietnam have generally guided those local firms to expect an increase in orders this year, according to our industry contacts. However, those Vietnamese factory managers also lament that their customers have essentially been giving them small lot and/or last-minute orders rather than the pipeline of 6-12 months’ work as they had in the past.

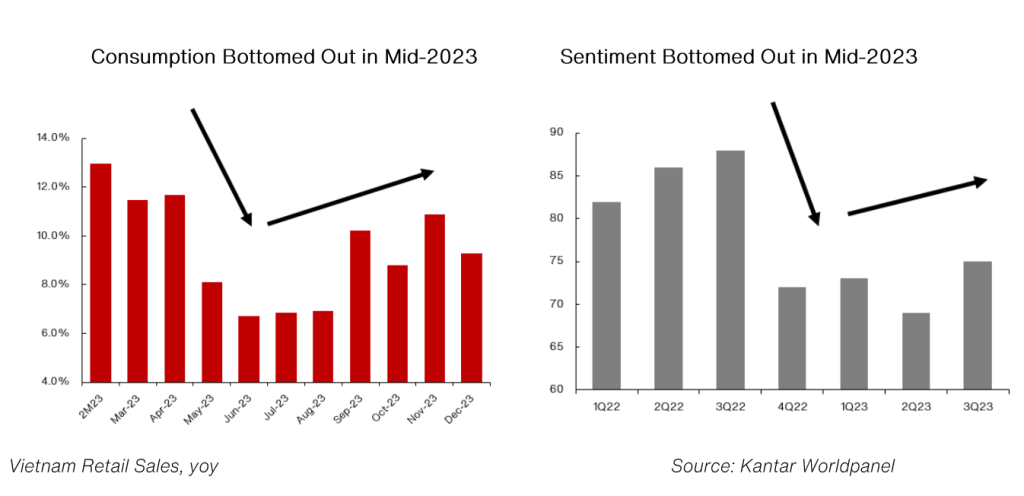

Domestic Consumption Recovery

In 2023, consumer spending in Vietnam was depressed by layoffs in the manufacturing sector – which affected lower-income consumers – and by the country’s “frozen” real estate market – which affected middle- and upper-income consumers, although this weakness was largely offset by a surge in foreign tourist arrivals. The number of foreign tourists visiting Vietnam leapt from 20% of pre-COVID levels in 2022 to 70% in 2023, accounting for most of the country’s 7.1% real retail sales growth last year.6 Consequently, we estimate that the growth of spending by local Vietnamese consumers (excluding tourists) was nearly flat last year. That said, consumer spending and sentiment in Vietnam both bottomed in mid-2023, as can be seen below.

One reason sentiment and spending started recovering in the middle of last year is that the employment picture started improving around that time. In early-2023, highly publicized factory layoffs were a major drag on spending and sentiment, but the pace of layoffs slowed by mid-2023; the layoffs were a direct consequence of the drop in exports, which had also slowed by then, and by late-2023, firms resumed hiring workers.

Specifically, factories started expanding their workforces in October, after having laid off workers for most of the year according to S&P Global’s PMI survey for Vietnam. Consequently, industrial employment expanded by nearly 1% month-on-month in October according to the General Statistics Office (GSO) and by the end of the year, industrial employment had fully recovered (i.e., it was essentially unchanged yoy). That said, wages grew by less than 5% yoy, which is lower than Vietnam’s typical 7-10% yoy factory wage growth, reflecting weak conditions in the labor market.

Consumer sentiment and spending got a further boost in late-2023 from the nascent thawing of the country’s “frozen” real estate market. The highly publicized slowdown in Vietnam’s real estate market negatively impacted consumer sentiment to a degree that is out of proportion to the reality of the issues that the market actually faces. Consequently, a modest thawing could disproportionately boost consumer sentiment this year.

Other Factors Influencing Consumption in Vietnam

The temporary surge of interest rates shown on the first page of this report weighed on home prices, which in-turn dampened consumer sentiment, but lower mortgage interest rates/monthly payments will also free up money for homeowners to spend on purchases (mortgage rates in Vietnam are floating and linked to banks’ deposit rates).

That said, last year’s temporary spike in savings rates generated windfall income for savers – some of which got spent in the economy (a similar phenomenon helps explain the surprising strength of he US economy last year). Consequently, it is difficult to disentangle the impact of last year’s temporary surge in interest rates on consumption in Vietnam, although lower rates will make it easier for consumers to finance purchases of “big ticket” items which should support consumption this year (outstanding consumer loans growth was very weak in 2023).

Finally, the labour and real estate markets were not the only influences on consumer spending last year – we focused on these factors because they had the biggest impact. For example, the Government’s temporary reduction in the VAT rate from 10% to 8% also supported spending, but we do not believe that cut was big enough to significantly influence consumer behaviour.

Understanding the Issues in Vietnam’s Real Estate Market

In a typical real estate “boom and bust” cycle, banks lend too much money to property speculators and real estate developers, which results in the market becoming vastly oversupplied with new housing units. At some point, the supply of credit dries up, crashing both real estate prices and property development activity. The market then languishes for years as it digests the existing oversupply of empty housing units.

This is not what is currently happening in Vietnam. Real estate development activity ground to a halt but not because there is an oversupply of empty housing units; Vietnam’s vacancy rate is below 5%.

Vietnam is Not in the Aftermath of a Bubble

Property development activity in Vietnam ground to a halt because of a confluence of legal and regulatory issues that make it very difficult to get new projects approved as well as certain market inefficiencies in financing the development of greenfield property projects. Critically, property prices in Vietnam have not crashed since the demand for new housing units outstrips supply by a factor of 2-to-1.

That said, the prices of some selected properties have dropped, especially if the homeowner not yet received a proper legal title from the developer, which in-turn is because the developer had not attained proper permissions to proceed with the project from the outset. Also, the prices of some properties that are poorly located or in geographies oversaturated with new housing units have dropped after having increased too much during what was admittedly a slightly frothy market in 2021 and early-2022.

Overly Negative Sentiment

Consumers and homeowners in Vietnam are peripherally aware of issues in the real estate market, and they occasionally read sensationalist headlines that property prices are plunging, prompting a reflexive reaction to limit their spending. But those sensationalist headlines do not reflect the reality of Vietnam’s real estate market.

For example, in December, a headline in one newspaper claimed “HCMC apartment prices drop 20% ,” which is not true. That article conveyed a few anecdotes, including of a 15% drop in the price of apartments in one particular building but then explained that the building “has been under construction for 8-10 years, yet title deed has not been issued”.

The same newspaper published an article a month earlier lamenting that “Affordable apartments are disappearing in Hanoi, HCMC”. We highlight this cognitive dissonance because misperceptions about the true health of Vietnam’s property market weighed disproportionately on consumer sentiment last year. Consequently, the growing perception that the country’s real estate market has started to thaw (which we discussed in this report) should boost consumer spending as 2024 progresses.

The Thaw Has Started

Recently, there have been a few very successful sales launches of well-located residential projects by leading developers, with over 80% of the units offered for sale sold immediately. Hopes are high that a special session of the National Assembly to be held later this month will resolve some the remaining roadblocks in the country’s real estate development market, which would probably also push the overall stock market higher.

There are numerous indications of increased urgency within the Government to fix the issues impeding the country’s real estate market. The Government recently projected an increase of well over 50% in the revenues derived from land-use rights fees on newly approved real estate projects in 2024, implying a significant increase in new project approvals. Furthermore, the Government has directly intervened in a growing handful of specific projects to resolve the legal and regulatory issues impeding those projects.

Vietnam’s FDI Story Keeps Getting Better-and-Better

Every year in our “Looking Ahead” reports, we remind readers of Vietnam’s key appeal to FOi investors: 1) wages are less than half those in China but the quality of the workforce is comparable, according to surveys by JETRO and others; 2) Vietnam’s geographic proximity to Asia’s high-tech industry supply chains; and 3) Vietnam is in the “friendshoring” cohort of countries at low risk of having tariffs imposed on their exports to the US.

Last year, Vietnam’s appeal to foreign investors continued to improve, as did the quality of the FOi the country attracted, which is captured in the two newspaper headlines above. The most important developments on both of these fronts were:

- The US and Vietnam raised their diplomatic relationship to a “Comprehensive Strategic Partnership,” further cementing Vietnam’s position in the US “friendshoring” orbit.

- Xi Jinping visited Vietnam three months after Joe Biden’s visit in September, making Vietnam the only country in Asia Xi visited last year and the only country that both Biden and Xi visited in 2023.

- Apple announced that it will move some key engineering functions to Vietnam for the first time, in addition to its current manufacturing/assembly activities.

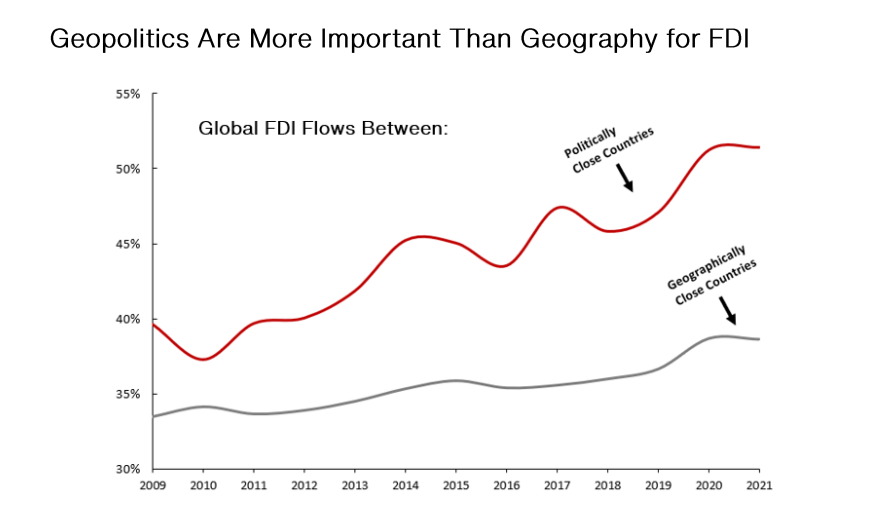

The first two points illustrate Vietnam’s unique position in the world’s evolving geopolitical landscape, which benefits investors because multinational companies that set up a factory in Vietnam need not worry about being able to sell their products into the US market nor their ability to access production inputs from China since Vietnam is being actively courted by both countries. The IMF, Atlantic Council and others have highlighted that geopolitics is becoming an increasingly important factor in how companies decide which countries to invest in, which can be seen below.

Next, Apple’s announcement that it will move some R&D activity to Vietnam for the first time follows its 2022 decision to start making the Apple Watch in Vietnam, which is a particularly complicated product to manufacture. Our Looking Ahead 2023 report cited Apple insiders who said the company has “big plans for Vietnam”. The transition from assembling products to actually designing those products is a further step up in the complexity of the activities the company conducts in Vietnam.

We mentioned in our previous reports (including this one) that the single most powerful growth driver for a country like Vietnam is an increase in the complexity of the products and services it is able to produce, according to research from Harvard and others; we believe Apple’s latest move is a step (albeit a modest one) towards the development of a semi-conductor industry in Vietnam, which is currently the subject of considerable discussion among executives from leading US and Taiwanese firms such as Nvidia.

Finally, the main caveat to all the positive points above is that Vietnam needs to accelerate infrastructure development in order to maximize high quality FOi inflows. Vietnam’s transportation and logistics infrastructure urgently needs to be upgraded, and FOi companies have concerns about Vietnam’s ability to reliably supply electricity to industrial users, following last summer’s power outages in northern Vietnam.

Global Minimum Tax (GMT) is Not a Risk to FOi

Some investors have asked questions about the possibility that Vietnam’s recent implementation of the new Global Minimum Tax (GMT) could impede FOi inflows by limiting the Vietnamese Government’s ability to offer tax incentives to entice FOi inventors. However, we are not overly concerned that GMT will impede Vietnam’s FOi inflows.

The primary reason we are not overly concerned is because tax incentives are not the main motivation for multinational companies to invest in one developing country versus another, according to research by the World Bank and others. Multinationals consider a wide variety of factors, such as wages, quality of the workforce, quality of infrastructure, and ease of doing business, in deciding where to invest.

In developed countries, all of those factors (workforce, infrastructure, etc) are fairly homogenous, so tax rates are a much bigger consideration when multinational companies consider investing in developed countries than when they invest in developing countries. For example, a multinational deciding whether to invest in Ireland or the UK would place far greater importance on a big difference in tax rates between both countries given that the workforce, infrastructure, etc. is similar in both.

This is not just a theoretical point. It is openly acknowledged that Ireland’s biggest attraction as an FOi destination – which prompted enormous investment inflows over the last 30 years – were the overly generous tax incentives that the country gave to multinationals, which is one of the main reasons GMT came about in the first place.

Stable Interest Rates in 2024

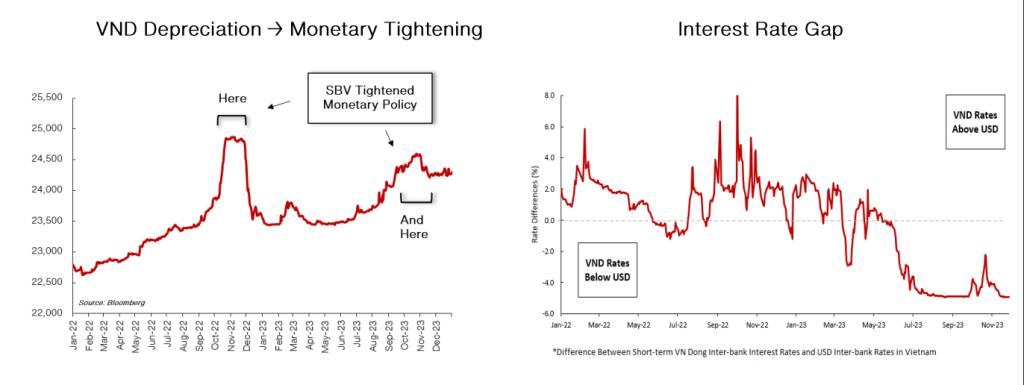

Deposit rates in Vietnam shot up by about 300bps and then fell all the way back to levels below where they had started within 18 months, starting in mid-2022. This substantial swing was driven by pressures on the value of the VN Dong, and it had a major impact on the VN-lndex and property market, as well as some impact on the “real economy”.

We expect interest rates to remain stable at around current levels for the foreseeable future, which would support the economy in a variety of ways. For example, many banks in Vietnam did not manage to reach their government-allocated credit quotas last year because high interest rates curtailed credit demand, adding to the existing woes in the property sector – although the other issues described above also weighed considerably on Vietnam’s real estate market last year.

Understanding the Swing in Vietnamese Interest Rates

In late-2022, the US Dollar/DXY Index surged by as much as 20% YTD, which drove a circa 9% depreciation in the value of the VN Dong. This prompted the State Bank of Vietnam (SBV) to hike interest rates by a total of 200bps and to use FX reserves to defend the value of the Dong. The SBV has repeatedly demonstrated a desire to contain annual USD-VND depreciations to 3%, and inflation in Vietnam averaged 3.2-3.3% in both 2022 and 2023, so the actions of Vietnam’s central bank were not influenced by inflation over the last two years.

In early-2023, Vietnam’s economy grew at a very slow pace, but the country’s trade surplus surged from about 0% of GDP in 1H22 to 6%/GDP in 1H23 because imports fell at a much faster pace than exports, which is discussed below. The swelling surplus enabled the SBV to slash interest rates (by a total of 150bps) in the first half of last year without putting undue pressure on the value of Vietnam’s currency.

However, as a result of the SBV’s interest rate cuts and the Fed’s interest rate hikes, short-term VND interbank interest rates fell to a level below USD short-term interest rates in the spring, and by September, VND interest rates were about 500bps below USD interest rates. The gap between VND and USD interest rates put renewed depreciation pressures on the value of the Vietnam’s currency, leading the USD-VND exchange rate to depreciate by more than 4% YTD at that time.

The SBV once again took action when the value of Vietnam’s currency had depreciated by more than 3%, but this time it responded in a more nuanced way to VND depreciation rather than resorting to more blunt tools like rate hikes or FX intervention. Specifically, the SBV drained about USD15 billion (3-4%/GDP) from Vietnam’s money market over a seven-week period (via “Open Market Operations”), which helped shore up the value of the Dong by putting some upward pressure on interbank interest rates, which can be seen in the chart above on the right.

That said, when the SBV took liquidity out of Vietnam’s economy in late-September to protect the value of the VN-Dong, it also meant that there was less VN Dong liquidity available to support stock prices – and liquidity is the single biggest factor that influences stock prices in the short-term in every country around the world. Consequently, after the SBV started draining liquidity out of the commercial banking system in late-September, the VN-lndex which had been up by as much as 24% YTD suffered a 16% sell-off, which we discussed in this report.

Why We Expect Stable Interest Rates in 2024

We have noticed a clear pattern over the last two years: Vietnamese policy makers tightened monetary policy whenever the value of the VN Dong depreciated by more than 3% YTD and then eased off the brakes once the value of the VND stabilized (see previous section).

In 2022, the value of the VND depreciated by 3.5%, driven by an 8% increase in the US Dollar/DXY Index (which had been up nearly 20% YTD at some points during the year), and in 2023 the VN Dong depreciated by 2.7% as a result of two forces pulling in opposite directions. The gap between USD and short-term VND interest rates reached a record high, putting depreciation pressure on the VND, but Vietnam’s trade surplus surged from 3%/GDP to 7%/GDP, which supported the value of the VN Dong, as did a 2% drop in the value of the DXY.

In 2024, Vietnam’s trade surplus is likely to swing from a large surplus to a modest trade deficit, which will put some depreciation pressure on the VND. However, the consensus expects the value of the US Dollar to fall as the Fed embarks on rate cuts. With pressures on the VND fairly balanced this year compared to over the last two years, we only expect modest depreciation pressure on the VND and do not anticipate that the SBV will be compelled to hike interest rates.

We also do not expect inflation to factor into the SBV’s decisions this year, partly because China is currently experiencing falling consumer prices, prompting many to anticipate that China will “export deflation” to the rest of the world; Vietnam would certainly experience lower increases in food prices, etc. as a result.

Notes on Vietnam’s Trade Balance

We mentioned above that we expect Vietnam’s trade balance to flip from a significant surplus in 2023 to a modest deficit in 2024, despite our earlier assertions that exports have already started rebounding. In 2023, exports fell by 4% to USD355.5 billion but imports fell by 9% to USD327.5 billion, resulting in a trade surplus that reached a record high of USD28 billion (or 7%/GDP) last year, according to the GSO.

That surplus supported the VN Dong by enabling the SBV to rebuild some of the FX reserves that it had spent in 2022 defending the Dong (the SBV actively bought USD in H1, enabled by the stable USD-VND exchange rate at that time). However, Vietnam’s record trade surplus was attributable to the fact that FOi factories slashed their imports of production materials in response to weak order books (local consumers also cut back on imported products such as automobiles, but FOi factories account for the vast majority of imports).

Since factories depleted their inventories of production materials last year, imports will necessarily need to outpace exports this year in order for those firms to rebuild those production material inventories. For example, we mentioned above that imports of electronics components are currently surging at about a circa 50% yoy pace. The net result of all of the above is that we are expecting a 7% increase in exports this year (which is in-line with the Government’s target), but a 15% increase in imports.

The Stock Market – Back to Fundamentals

In 2023, Vietnam’s stock market was driven higher – and then lower – by monetary policy, but the VN-lndex finished the year up 12.2% in VND terms and 9.3% in USD terms. Specifically, a drop in deposit interest rates, coupled with steps the Government took to support the country’s corporate bond market in March9 drove a rally the pushed the VN-lndex up as much as 25% (YTO) over the next six months, despite Vietnam’s weak economy at that time. And then in September, the SBV tightened monetary policy in response to a ~4% YTD depreciation in the VN Dong, which helped fuel the 16% correction in the VN-lndex that can be seen below.

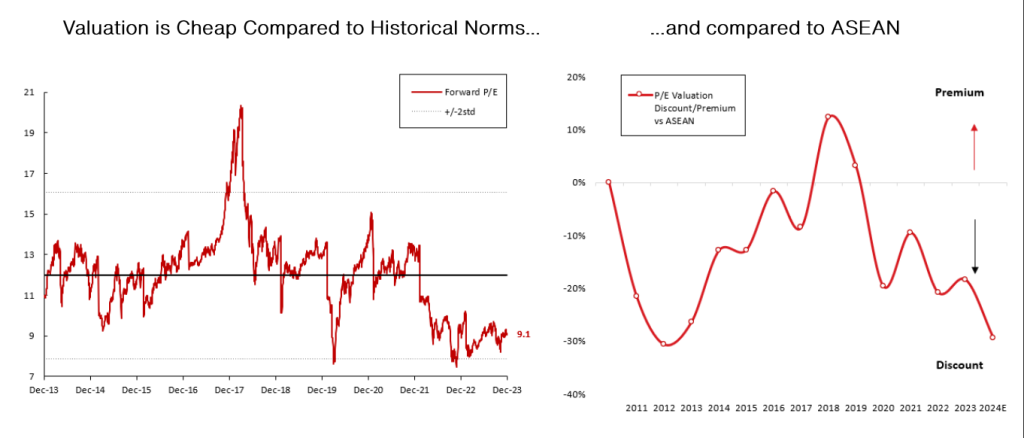

In 2024, we expect interest rates to remain stable and for investors to re-focus on earnings growth and valuations, both of which should support an increase in stock prices_ Specifically, we expect the earnings of the Vietnam’s listed companies to recover from no growth in 2023 to 10-15% earnings growth in 2024, and our 2024 forecast is slightly below the current market consensus_ Additionally, the market’s valuation is cheap and there are a few catalysts that could push it higher in early-2024.

Further to that last point, it is widely anticipated that implementation of the stock exchange’s new KRX trading system in 01 will help solve certain technical problems, which in turn could lead to Vietnam being upgraded from a Frontier Market to an Emerging Market by FTSE-Russell later in the year. Hopes are also high that a special session of the National Assembly in January will help solve some of the issues discussed above that are currently impeding real estate development.

In addition, Vietnam’s economic growth and corporate earnings results in 1H24 will both be flattered by the fact that both were both very weak in 1H23. GDP growth accelerated steadily throughout 2023, doubling from 3.3% yoy growth in 01 to 6.7% growth in 04. That acceleration is encouraging because the country’s economic recovery is gaining momentum and low growth numbers in early-2023 will also likely lead to encouraging news headlines about companies’ surging earnings, attracting investors’ attention to the stock market.

Stock & Sector Selection Drives Outperformance

We expect the overall earnings of Vietnam’s stock market to recover from no growth in 2023 to 10-15% earnings growth in 2024, but with a wide variation in earnings between sectors. For example, listed consumer companies’ earnings dropped by around 20% last year and we expect those companies’ earnings to surge by more than 30% this year with the ongoing rebound in consumer spending. Likewise, the earnings of listed real estate developers (excluding Vinhomes) fell by around 50% last year, but we expect those companies’ earnings to surge by more than 100% this year driven by a modest pick-up in real estate development activity.

The magnitude of both of those sectors’ swings is much greater than the swing we expect for the overall market, from no growth in 2023 to 10-15% growth in 2024. Such large performance dispersion presents active portfolio managers like VinaCapital with ample opportunities to continue to outperform the broader stock market.

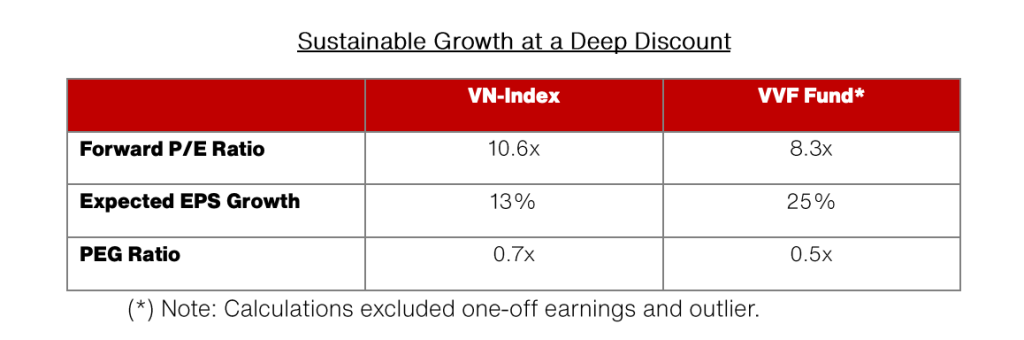

For example, the market’s overall valuation is already attractive at 1Ox Forward P/E versus 10-15% EPS growth, which equates to a Price-Earnings-Growth (PEG) ratio of about 0.7x (legendary stock market investor Peter Lynch popularized picking stocks with PEG ratios below 1x), but as can be seen in the table below, the specific stocks in our VVF Vietnam Equity UCITS Fund are trading at a P/E ratio of 8x and we expect the earnings of those stocks to grow by 25% this year.

Similar stock selection over a long-time horizon helps explain why our VVF fund was able to significantly outperform the market over the last 1, 3, and 5 years (over the last 5 years VVF’s NAV increased by an average of nearly 10% annually versus the VN-lndex’s 4% average annual increase).

Sector Preferences

Outperforming the overall stock market entails savvy selection of sectors and individual stocks. Our current preferred sectors include IT, selected Banks, Real Estate Developers (ex-Vinhomes), Consumer Discretionary companies, and Securities Companies.

Consumer companies will benefit from the ongoing recovery in consumer spending in Vietnam discussed above, so we expect the earnings of listed consumer companies to rebound from a 22% drop in 2023 to a 33% surge in 2024, despite a modest expected acceleration in the overall level of real retail sales growth, from 7.1% in 2023 to 7.5% in 2024.

Further to that last point, the divergence between the modest acceleration in Vietnam’s total retail sales growth (from 7.1% in in 2023 to 7.5% in 2024) stems from the facts that: 1) spending by local consumers (excluding foreign tourists) will likely increase from an estimated 2-3% growth in 2023 to 7-8% in 2023, and 2) the consumer companies that are listed on Vietnam’s stock market derive more of their revenues from selling to local consumers than from selling to tourists – so these firms’ revenues and earnings will benefit from the bounceback in domestic spending this year.

Real estate developers (ex-Vinhomes) should benefit from a modest pick-up in real estate development in Vietnam this year – which would be in-line with the Government’s own projections – and which would likely lead to a rebound in the sector’s earnings from a 51% drop to a 109% surge in 2024. Note that we isolated Vinhomes (VHM) from our analysis for two reasons: 1) the scale of the company is much larger than the rest of the firms in the industry, with a market cap six times that of Vietnam’s second largest listed developer, and 2) the company’s earnings are likely to drop by about 20% this year after having increased by nearly 30% in 2023 (that drop is primarily related to the timing of booking of the company’s revenues).

Bank stocks should benefit from an acceleration in their earnings growth from around 7% in 2023 to 18% in 2024 and the valuation of bank stocks in Vietnam is currently more than one standard deviation below its five-year mean (banks are currently trading at about 1.8x P/B versus circa 17% expected ROE in 2024). We expect the earnings of Vietnam’s banks to be driven by an acceleration in credit growth to both real estate developers and to the end-buyers of newly constructed housing units, in-line with our expectation for a modest pick-up in real estate development this year.

Vietnam’s IT sector is synonymous with FPT, which essentially comprises the whole sector. FPT’s software outsourcing business continues to go from strength to strength, which helped push the company’s revenues above USD1 billion for the first time last year, but we expect FPT’s overall revenues to accelerate from 20% growth in 2023 to 24% in 2024 despite that impressive accomplishment.

FPT benefits from the continued robust growth in global IT spending and it is very strong in several specific niches such as developing software to manage utilities across the globe, developing the software embedded in smart televisions, and the company launched an automotive software business last year, with initial customers including Hyundai, Honda, and Volvo.

Securities companies’ earnings should accelerate from 14% growth in 2023 to 38% growth in 2024 because lower interest rates will facilitate more margin trading and because IB activities that were put on hold last year due to the slow economy are likely to resume this year.

Finally, in addition to the aforementioned sector preferences that guide the overall stock selection of VinaCapital’s portfolio managers, Vietnam’s stock market has hundreds of small- and mid-cap stocks, many of which are not closely followed or fully understood by domestic retail investors. This opportunity set is another source of potential market outperformance because it enables professional investors like VinaCapital to find hidden gems that can significantly outperform the market.

Furthermore, the performance of small and mid-cap stocks in Vietnam sometimes diverges considerably from that of the overall market; last year, small- and mid-cap stocks both surged by about 30% , far outpacing the market’s overall performance. This also enables nimble investors to outperform the overall market.

Conclusions

We expect Vietnam’s GDP growth to increase to 6-6.5% in 2024, driven by a rebound in the manufacturing sector and by improvements in consumer sentiment and spending. Manufacturing had already started rebounding in late-2023 because the demand for “Made in Vietnam” products – especially for consumer electronics products – from consumers in the US/EU started to recover last year.

Consumption by Vietnamese consumers (excluding tourists) also already started rebounding in late-2023 because of improvements in the labour market and because Vietnam’s “frozen” real estate market has started to thaw, thanks in part to last year’s big decline in interest rates. Lower interest rates also supported the stock market in 2023, but we expect rates to remain much more stable this year and for stock market investors to re-focus on fundamentals this year.

Consequently, a modest expected increase in earnings growth, coupled with the market’s cheap valuations, should help drive a modest increase in Vietnamese stock prices this year, especially given potential catalysts including the widely anticipated implementation of the stock market’s new KRX trading system, which would ultimately help pave the way for the market to be upgraded to an “Emerging Market”.

Finally, we expect a fairly wide dispersion in the performance of individual stocks and sectors in the stock market, which will once again enable active managers like VinaCapital to outperform the overall stock market. In short, the valuation of Vietnam’s stock market is attractive at 10x P/E versus 10-15% expected earnings growth, but the valuation of the stocks that VinaCapital’s flagship VVF fund hold is even more attractive at 8x P/E ratio, versus expected earnings growth of 25% this year.