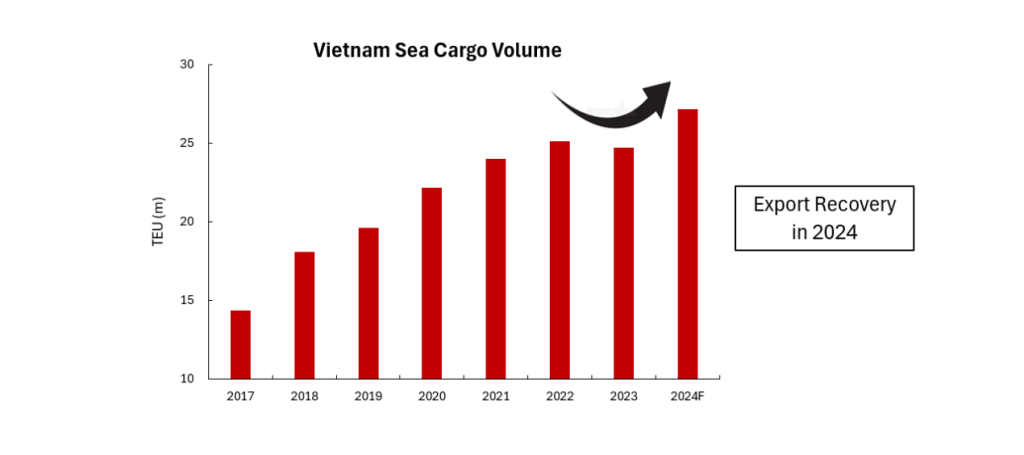

The recovery of exports has had a positive impact across several sectors of Vietnam’s economy – it was largely responsible for the country’s 5.7% GDP growth in 1Q24, a significant boost1 from the 3.4% growth recorded in 1Q23. Exports to the US, Vietnam’s largest market, rebounded from a 21% drop in 1Q23 to a 24% surge in 1Q24. The sharp increase in exports boosted Vietnam’s air and sea cargo volumes by an estimated 40% yoy and 30% yoy respectively in the first quarter of 2024. As a result, the stock prices of leading local logistics companies such as Gemadept, Saigon Port, and Saigon Cargo Service Corp, that focus on international trade have jumped 50% yoy, far outpacing the 20% yoy increase in the broader VN-Index.

Exports began recovering in mid-2023, resulting in higher capacity utilization of ports in Vietnam. Those recoveries, coupled with the announcement that Government-regulated port handling fees would increase by around 10% this year, were the initial catalysts for the surge in logistics stock prices over the past year, although other factors discussed below also supported the stock prices of both logistics’ companies and of industrial park developers, which are also up approximately 50% yoy.

We expect Vietnam’s export recovery to continue beyond 2024. The strong US economy is boosting exports across Asia, and US imports grew at a remarkable 7% rate in Q1 and look likely to remain strong this year. Factories in Asia are reporting robust new orders driven by strong demand from the US. In April, the “new orders” subindex of S&P Global Emerging Markets PMI hit its highest level in over three years, with new orders in Vietnam reaching their highest level in nearly two years.

Export Recovery Propelling the Logistics Sector

In early-2023, companies in the US and other developed countries slashed their orders to factories in Asia to destock bloated inventories, but by the end of last year, Vietnam’s export recovery was gaining momentum as that destocking process wound down. By early-2024, Vietnam’s total trade flows (i.e., both imports and exports) were growing at a 15% rate and revenues derived from air and sea cargo handling were growing by over 30% yoy, which is one reason logistics companies’ share prices have soared this year.

We highlighted the “air and sea cargo revenues” of Vietnamese logistics firms above because some of those firms (including market leader Gemadept) also earn significant revenues from shipping goods in addition to handling cargo. However, shipping revenues are currently plunging because global shipping rates soared during 2020-21 and have subsequently collapsed.

About one-third of the revenues of logistics firms focused on international trade (as opposed to those focused on domestic shipments) is derived from shipping. Contracts signed in the heady days of 2020-21 are now rolling off, so we expect nearly flat overall revenue growth for those firms this year despite robust cargo growth and higher port-handling fees.

That said, investors are looking past the anomalous surge and collapse in shipping rates and are enthused about other factors including the prospect for further Government-regulated port fee increases, and capacity increases, which have raised hopes Vietnam could eventually become an international trans-shipment hub akin to Singapore.

Increased Capacity

Capacity at the Cai Mep-Thi Vai deep water port complex, which is 60km from HCMC and includes berths owned and operated by Gemadept, Saigon Port JSC and other logistics firms, is set to increase by more than 10% next year; Gemadept will double the number of berths it operates in Cai Mep-Thi Vai2. Capacity at the Lach Huyen deep water port complex near Hai Phong, which is owned and operated by several SOEs, is set to increase 1.5x fold by next year, including an 80% capacity increase scheduled for end-2024.

The Government is also considering constructing a dedicated transshipment port at Can Gio, which is near Cai Mep-Thi Vai. This could compete with Singapore and Hong Kong for transshipment business, as Vietnam’s port handling fees are still roughly half those in Singapore, even after the circa 10% hikes in port handling fees that went into effect earlier this year. In addition, construction of HCMC’s new Long Thanh Airport continues to progress, with a new cargo terminal set to break ground later this year. Both of these are part and parcel of the Government’s infrastructure development plans; Government infrastructure spending increased by about 33% to $24b (or 6%/GDP) last year, and we expect a comparable level of spending this year.

VinaCapital’s Logistics Focus

VinaCapital identified logistics as one of the sectors with the most promising investment opportunities (which we discussed in this logistics sector report published last year). The firm’s logistics focus led our listed equity portfolio managers to overweight logistics stocks in their portfolios last year because we had anticipated both the drop in Vietnam’s trade flows in 2023 and the subsequent 2024 recovery (which we discussed in our “Looking Ahead 2023” and “Looking Ahead 2024” reports). That overweighting helped our firm’s open-ended equity funds outperform the VN-Index.

Our private equity professionals partnered with A.P. Moller Capital to launch a logistics PE fund that will invest in private Vietnamese companies that are engaged in highly promising logistics activities such as air cargo handling – which is growing at an extremely fast rate – and smart warehouses, a niche which has gained considerable interest from international investors.

Export Recovery Supporting Industrial Parks

The share prices of industrial park (I/P) operators are up around 50% yoy, although the link between Vietnam’s export recovery and the surge in I/P stock prices is not as direct as with logistics firms. In short, higher exports are encouraging more FDI inflows – newly registered FDI was up more than 50% in 5M24 to nearly USD8b or 4%/GDP – and most multinational manufacturers set up their factories in industrial parks. In addition, multinational manufacturers of high-tech products are pushing up I/P lease rates as they tend to be less sensitive about the I/P rental rates than are the producers of lower value-added products such as garments and furniture.

Further to that last point, Vietnam’s export recovery is being driven by a surge in the exports of high-tech products, which are typically shipped by air; we mentioned above that Vietnam’s air freight volume growth (circa 40% yoy) is outpacing sea freight volume growth (~30% yoy). Exports of laptops and other home electronics products grew by more than 30% yoy in 5M24, double the country’s 15% overall export growth, which is supporting current FDI inflows from manufacturers of high-tech products.

Finally, there is a limited supply of readily available I/P land3. Occupancy rates at I/Ps in the north of Vietnam, which attracts the majority of new high-tech FDI investment, are currently over 80% on average and occupancy rates at I/Ps in the greater HCMC area are over 90%. The combination of price insensitivity by high-tech manufacturers, coupled with high occupancy rates, pushed up lease rates in the north and south by 35% and 15%, respectively, last year and we expect a further 7-10% nationwide increase in rental rates this year.

Conclusions

Vietnam’s export recovery has helped propel a circa 50% yoy increase in the stock prices of leading local logistics companies that focus on international trade, as well as those of industrial park developers. Export volumes across Asia started recovering last year, and have subsequently accelerated, resulting in air and sea cargo volumes surging by an estimated 40% yoy and 30% yoy respectively in 1Q24. That surge, coupled with rising Government-regulated cargo handling fees and the progress of ongoing capacity expansions, have lifted investors’ interest in logistics stocks over the last year.

The export recovery has also helped boost I/P stock prices. That’s partly because a surge in high-tech exports is driving the export recovery and prompting more FDI inflows from the manufacturers of high-tech products – and those producers of high value-added products can pay higher lease I/P lease rates. Finally, VinaCapital’s portfolio managers understood the direction of the future export growth and companies that were likely to benefit and increased their exposure and added positions in both logistics and I/P developer stocks to their portfolios in the lead-up to the export recovery, helping our open-ended equity funds significantly outperform the VN-Index since last year./.