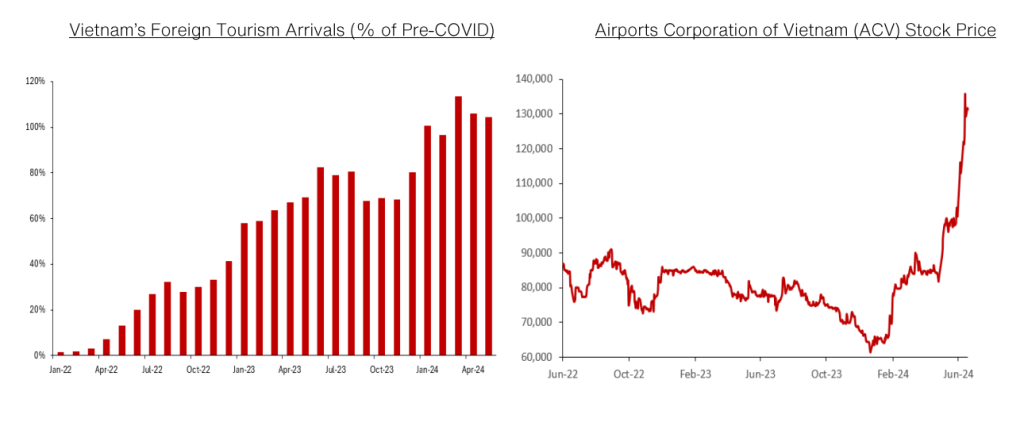

The number of international tourists visiting Vietnam surged 65% yoy in 5M24, and is now slightly above pre-COVID levels, despite the fact that Chinese tourist arrivals in Vietnam – and in the rest of Asia – remain well below 2019 levels. Chinese tourists previously accounted for one-third of Vietnam’s total foreign tourist arrivals and China only reclaimed its position as the largest source of visitors to Vietnam last month for the first time since COVID. The ongoing recovery of Chinese tourist arrivals, coupled with the current, extraordinary desire of Americans to travel (discussed below), means that the total number of foreign tourists visiting Vietnam will likely exceed pre-COVID levels by more than 5% this year.

Foreign tourism accounted for about 8% of Vietnam’s GDP1, pre-COVID (versus 12% in Thailand), so Vietnam’s continued tourism recovery in 2024 should add over 1%pts to the country’s GDP growth this year, after having boosted GDP growth by more than 4%pts last year. Domestic tourism accounts for an additional 4% of Vietnam’s GDP, but domestic tourism had already fully recovered last year, so increased spending by domestic tourists will not make a major contribution to the country’s GDP growth this year. Taken together, foreign and domestic tourism accounted for about 12%/GDP, pre-COVID.

The recovery in foreign tourist arrivals after Vietnam re-opened its borders was initially driven by Korean and American tourists, and then China lifted its “Zero COVID” restrictions in 2023. Vietnam also eased its tourist visa requirements last year, which helped boost the revenues of travel-related companies this year. Local tour operators’ revenues are up nearly 50% in 5M24 and the stock prices of Vietnam Airlines (HVN) and of Airports Corporation of Vietnam (ACV), the country’s leading airport operator, are up by nearly 200% and by more than 100% YTD respectively – although the stock price of budget airline Vietjet (VJC) is flat this year, partly because its share price rose in the lead-up to Vietnam’s COVID re-opening.

Finally, hotel room occupancy in Vietnam is still about 20% below pre-COVID levels, primarily because Chinese tourist arrivals are still 25% below pre-COVID levels. Chinese and Russian tourists account for a significant proportion of the “mid-market” traveler cohort, a segment of the market that has not fully recovered, in our understanding. However, higher end properties such as the Hanoi Metropole, the Fusion Resorts and other premium properties owned and operated by Lodgis, a joint venture between VinaCapital and Warburg Pincus, are at-or-above pre-COVID levels (occupancy at some of those properties are “well above” pre-COVID levels, according to our Lodgis colleagues).

Directly and Indirectly Boosting Vietnam’s Economy

The number of foreign tourists visiting Vietnam jumped by more than 200% last year to nearly 13m people, or from 20% of pre-COVID levels in 2022 to 70% in 2023. That surge directly boosted GDP growth, but we estimate that purchases by foreign tourists account for about 10% of retail sales in Vietnam and we observe that foreign tourism puts money into the hands of a wide range of local merchants, further boosting the economy, albeit indirectly. We estimate that the total contribution of tourism to Vietnam’s economy – including both the direct and indirect contributions – is over 15% of GDP.

The Recovery in Chinese and US Tourist Arrivals

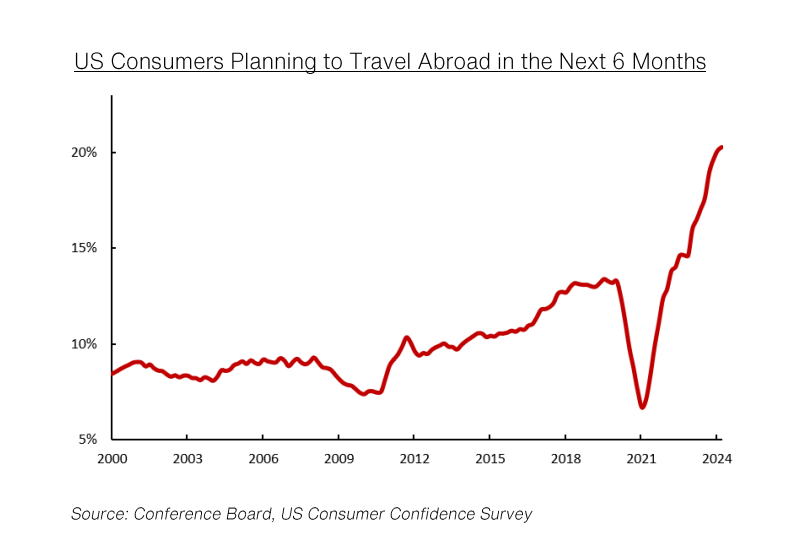

The proportion of Chinese consumers who intend to travel abroad nearly doubled versus last year – to nearly two-thirds of those surveyed2 and the proportion of US consumers planning to travel abroad in the next six months nearly doubled versus pre-COVID levels – reaching record-high levels, as can be seen in the chart below.

In 5M24, the number of Chinese tourists visiting Vietnam soared by more than 300%, reaching 75% of pre-COVID levels. The Chinese Tourism Academy expects outbound Chinese tourism to exceed 80% of pre-COVID levels this year, so we are expecting Vietnam’s Chinese tourist arrivals to recover from 30% of pre-COVID levels last year, to 85% this year. That partial recovery is the basis for our forecast that Vietnam’s total tourist arrivals will recover from 70% of pre-COVID levels last year to 19m arrivals, or about 105% of pre-COVID levels this year.

China and Japan are the world’s only two major countries in which outbound tourism has not yet recovered to pre-COVID levels (China was the world’s highest spending outbound tourism market, pre-COVID). China’s weak recovery stems from the fact that the country only dropped its Zero COVID restrictions last year and from the relatively weak state of the country’s economy, although China’s domestic tourism spending is expected to exceed pre-COVID levels this year. Meanwhile in Japan, the dramatic plunge in the value of the Yen is impeding outbound tourism.

US Spending Spree Supporting Tourism in Vietnam

A recent Wall Street Journal (WSJ) article3 highlighted that an unprecedented amount of cash is being put in the pockets of millions of Americans (especially “Baby Boomers”) from their surging investment income – and savers are spending some of that newfound income on luxuries like travelling abroad. The interest and dividend income US savers earn is on track to jump nearly by 5x from USD770b in 2020 to USD3.7T and there is ample evidence that consumers are spending some of that income on travelling. US airports had three record-breaking days over the last month and according to another WSJ article5 published last week, “Europe has a New Economic Engine: US Tourists”. In Vietnam, US tourist arrivals are well above pre-COVID levels and spending by those relatively affluent travels helps explain the high occupancy rates of upscale hotels.

Conclusions

We expect the number of foreign tourists visiting Vietnam to increase by 40% this year – driven by the continued recovery of outbound Chinese tourism. Foreign tourism accounted for about 8% of Vietnam’s GDP pre-COVID, so we expect the continued recovery of tourist arrivals to add more than 1%pts to Vietnam’s GDP growth this year. We also note that the revenues and stock prices of travel-related companies such as airport operators and airlines have soared this year, as have the occupancy rates of premium hospitality properties, including those owned and operated by the Lodgis joint venture between VinaCapital and Warburg Pincus./.