By: Linh Vu, Head of Research

Duc Le, Research Analyst

Today, FTSE Russell announced the reclassification of Vietnam from Frontier to Secondary Emerging Market (EM) status, with an effective date on Monday, September 21, 2026, subject to an interim review in March 2026.

The FTSE Russell Index Governance Board acknowledged that Vietnam has met all the criteria required of the Secondary Emerging market status under its framework. However, the Advisory Committee received feedback regarding the limited access to global brokers to trade in Vietnam. Although this is not a requirement to attain Secondary EM status, it is an important issue for index users, and Vietnam will undergo an interim review in March 2026 to determine whether sufficient progress has been made in enabling access to global brokers. This is essential to support index replication and meet the needs of the international investment community. Provided this concern is resolved, confirmations and details of the phased implementation plan will be announced in March 2026.

We are reasonably confident that Vietnamese market authorities will be able to address this issue, and Vietnam’s upgrade will proceed as planned in September 2026.

A phased-in inclusion

Chart 1: Timeline for the reclassification of Vietnam from Frontier to Secondary Emerging Market

Considering local market liquidity, and the pre-funding capacity of domestic securities firms in Vietnam, index tracker funds’ purchases will be executed in multiple tranches. Given the size of Vietnam’s stock markets, we expect the inclusion to be divided roughly equally into two tranches.

This upgrade recognizes the Vietnamese government’s focused efforts, particularly over the past two years, in taking a holistic approach to reform. These efforts include investing in technological infrastructure, introducing new financial products, strengthening regulatory frameworks, enhancing corporate transparency, and improving market accessibility for foreign investors. Over the past three years, Vietnam has witnessed significant capital outflows of USD 8.5bn, but we believe this market reclassification could serve as a turning point, positioning Vietnam to attract foreign inflows from Emerging Market funds.

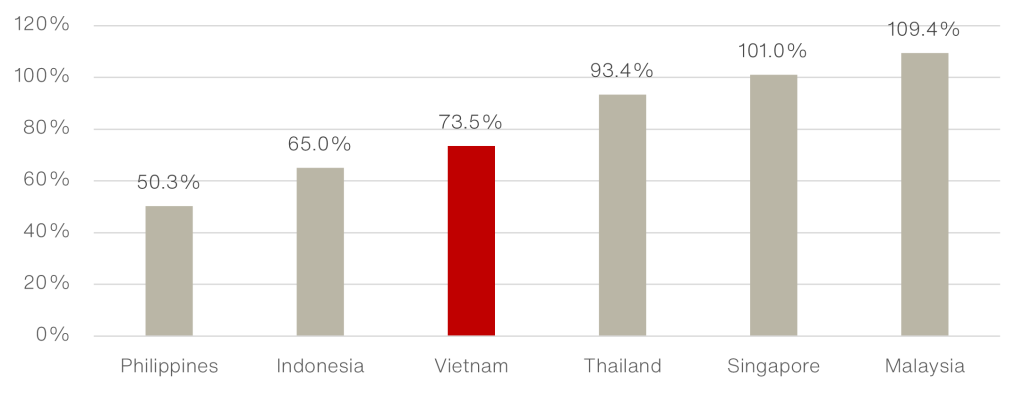

This announcement, however, should not be viewed as a final destination or goal. Rather it is a starting point that will bring new requirements and challenges for further development — with the ultimate aim of expanding Vietnam’s stock market to 120% of GDP by 2030 from the current level of c.75% of GDP.

Chart 2: Stock market capitalization as a percentage of GDP

Fund flows analysis

The EM upgrade by FTSE Russell could potentially add USD 5-6bn in capital inflows to Vietnam. Once upgraded, Vietnam will be included in the FTSE EM All Cap Index (approx. USD 100bn tracking). We estimate that Vietnam could account for 0.3% of the Index (equivalent to USD 300mn in passive flows for the FTSE EM All Cap Index) with 30 stocks to be included.

Table 3: Potential list of 30 stocks for FTSE EM index inclusion

Beyond the EM upgrade

Achieving Emerging Market status represents a notable milestone for Vietnam; however, the more critical challenge lies in securing and consolidating this position over the long term. This will require additional comprehensive reforms to further deepen, modernize, and enhance the resilience of the capital markets.

Establishment of a Central Counterparty (CCP) system by end 2026

While the Non-Prefunding (NPF) model provides an interim measure to support the FTSE upgrade, the establishment of a Central Counterparty (CCP) system constitutes a long-term solution. In alignment with MSCI standards, the government has outlined plans to establish a CCP subsidiary under the Vietnam Securities Depository and Clearing Corporation (VSDC), with the necessary legal and institutional framework expected to be completed by the end of 2026 and the system scheduled to become operational in the first quarter of 2027.

Table 4: Vietnam CCP Timeline

Improving foreign investor access is critical

Phasing out foreign ownership limits is a key element of improving access. At the same time, it is crucial to establish regulatory framework for FX hedging instruments, as this will allow long-term institutional investors to more effectively mitigate currency risks when investing in emerging markets. Other issues such as the absence of detailed disclosures in English and market data standardization should be further improved to enhance foreign investor interest.

Better sector diversification and more high-quality IPOs needed

Vietnam’s stock market currently relies heavily on two key sectors — Financials (37%) and Real Estate (19%). A more diversified sectoral composition would help the market better reflect the overall economy and reduce the heavy dependence on Banks and Real Estate. To some extent, we believe that the upcoming wave of IPOs will boost market capitalization and help rebalance the stock market’s industry composition. This diversity also enhances market liquidity and attracts a broader range of investors with varying strategies and risk appetites. In the long run, a well-diversified market fosters sustainable growth, strengthens investor confidence, and supports the continued development of the capital markets.

Vietnam’s capital market – An ambitious journey ahead

Year to date, Vietnam’s stock market has achieved growth of over 34% in VND terms, with market liquidity currently leading the ASEAN region — averaging around USD 1 billion in daily trading value. However, the overall size of Vietnam’s stock market (over USD 300bn across the three exchanges) remains modest. According to the Government’s Stock Market Development Strategy to 2030 (Decision No. 1726/QĐ-TTg dated 29 December 2023), the goal is to expand the equity market to 120% of GDP by 2030 — from the current 73.5% — and to grow the bond market to at least 58% of GDP, nearly double the current total outstanding bond value of 32% of GDP. Corporate bonds are expected to reach at least 25% of GDP by 2030, compared to less than 10% today. Vietnam is also working toward meeting the necessary requirements for eventual inclusion in the MSCI Emerging Markets Index, which would attract more meaningful capital inflows.

Beyond expanding in scale, we believe the more important and ultimate goal for the government is to build a solid foundation for national financial autonomy — strengthening the internal capacity of Vietnamese enterprises, enhancing transparency in corporate governance, and enabling them to compete and integrate into global markets.

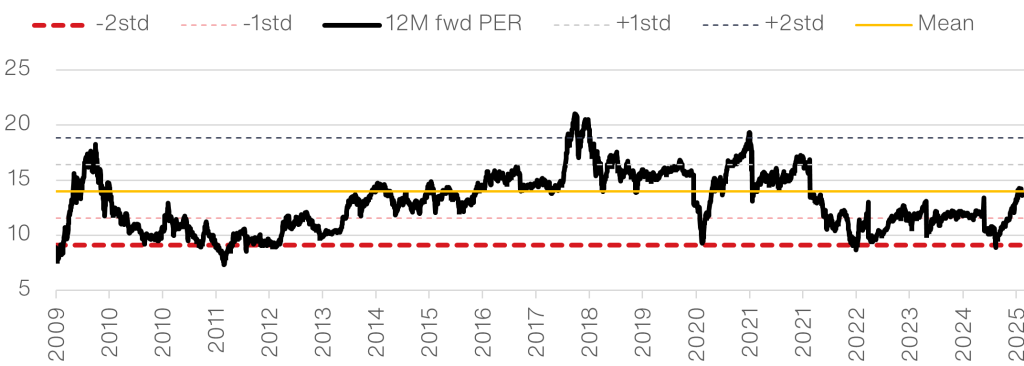

As a market participant, our outlook is positive. In the long term, we believe that economic growth remains the key determinant of the stock market’s performance. Vietnam’s stock market still trades at an undemanding valuation of 13x forward P/E. Amid the market upgrade, we believe the VN-Index’s valuation offers 15-20% upside in the next 12-18 months. This reflects Vietnam’s optimistic economic prospects, supportive government policies, approximately 15% corporate earnings growth expected over the next 1-2 years, and a potential valuation re-rating of the VN-Index post-EM upgrade.

Chart 5: VN-Index forward P/E