by: Michael Kokalari, CFA, Chief Economist

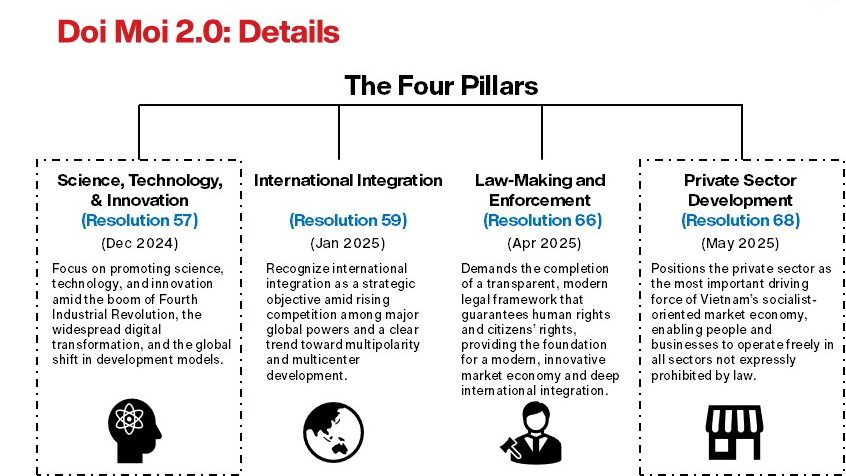

VinaCapital’s 2025 Investor Conference, which was held on 27–29 October at the Park Hyatt Saigon in Ho Chi Minh City, focused on “Vietnam 2.0”, the country’s next phase of development that is being shaped by sweeping, forward-looking Government reforms and driven by the country’s private sector (see a summary video of the Conference here). With a focus on science, technology, and innovation, Vietnam 2.0 aims to achieve the goal of Vietnam becoming a developed nation by 2045. Speakers from Vietnam and abroad—including representatives from the State Securities Commission of Vietnam, the Ho Chi Minh City People’s Committee, Sumitomo, Warburg Pincus, A.P. Moller Capital, Vertex, Masan Group, Synopsys, Marvell Vietnam, Vinamilk, FPT Retail, and BIDV — expressed enthusiasm for Vietnam’s ongoing “Doi Moi 2.0” reforms, which are built around four key pillars that are reshaping how the Government sets priorities and delivers results.

The Government’s reforms are also creating a series of investment opportunities for investors, and VinaCapital’s suite of public market, private market, and alternative investment strategies (summarized in Appendix 1) provides multiple ways to access them.

The Four Pillars of Doi Moi 2.0

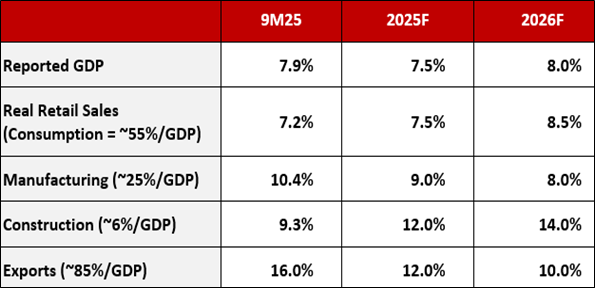

Our Forecasts for 2025 and 2026

Doi Moi 2.0 already proving effective. Don Lam, VinaCapital’s CEO and Founding Partner, noted in his opening speech that Doi Moi 2.0 was already yielding important results, with the merger of key Government ministries, reducing the number of provinces from 63 to 34, and streamlining large parts of the state’s administrative structure. He added that policymakers are moving with a sense of urgency to roll out private-sector policies (many of which he advises on as Vice Chairman of the Private Sector Development Committee) aimed at supporting Vietnam’s goal of becoming a high-income nation by 2045. Echoing this reform momentum, H.E. Nguyen Van Duoc, Chairman of the Ho Chi Minh City People’s Committee, delivered the Conference’s keynote speech, in which he discussed Vietnam’s new era of “breakthrough and acceleration,” enabled by a series of important Government reforms.

Resolution 68. Chief among these reforms is Resolution 68, which upgrades the private sector to “the most important driving force” of the economy. VinaCapital Fund Management CEO (and group COO) Brook Taylor described how Resolution 68 aims to build at least 20 national champions and double the number of SMEs in the country to ~2 million by 2030, and how investing in these private enterprises with long-term growth capital can help drive the country’s economic success going forward. Brook also shared how VinaCapital is well positioned to capitalize on the opportunities presented by the Doi Moi 2.0 reforms, which are expected to have far-reaching short-term and long-term positive effects.

Positive short- and long-term outlook. Government reforms are expected to help rebalance Vietnam’s key growth drivers, with internal drivers playing an increasingly important role going forward. We expect the Doi Moi 2.0 reforms will add about two percentage points to Vietnam’s long-term growth potential, partly by reducing Government bureaucracy and by expediting the approvals of real estate and infrastructure projects; much more authority in approval of public projects is being delegated to local levels, which should lead to faster execution.

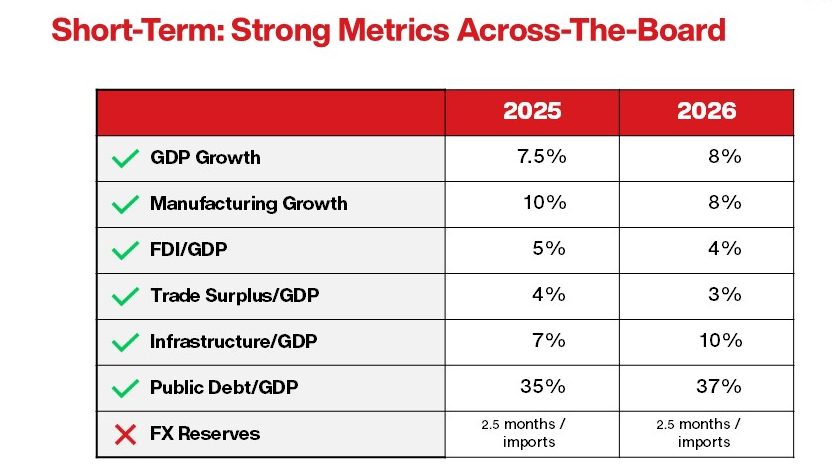

Strong GDP growth in 2025 and 2026.Vietnam’s economy grew by a remarkable 7.9% in 9M25 (as shown in the table above), but was driven unevenly by two main external factors: First, a near 30% rise in exports to the U.S. (driven, in turn, by a nearly 50% surge in Vietnam’s exports of electronics and other high-tech products); and second, a jump in foreign tourist arrivals, especially from China (overall tourist arrivals are up more than 20% YoY). A significant factor supporting Vietnam’s high exports of electronics is Apple’s decision to shift more production of MacBook computers and other products sold in the U.S. from China to Vietnam – among other factors.

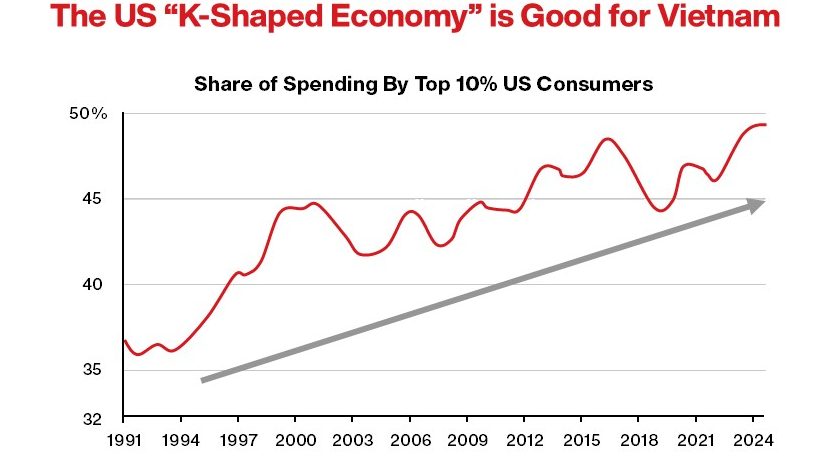

Export growth normalization. We expect the extraordinary increase in Vietnam’s exports to the U.S. this year to moderate next year, which would in turn drive a modest drop in manufacturing output growth because most products that are made in Vietnam are sold to overseas customers, and the U.S. is Vietnam’s biggest export market. That said, we do not expect the export growth to collapse, partly because the so-called “K-Shaped economy” in the U.S., which has been garnering more attention in the international business press and which benefits countries like Vietnam that export to the U.S.

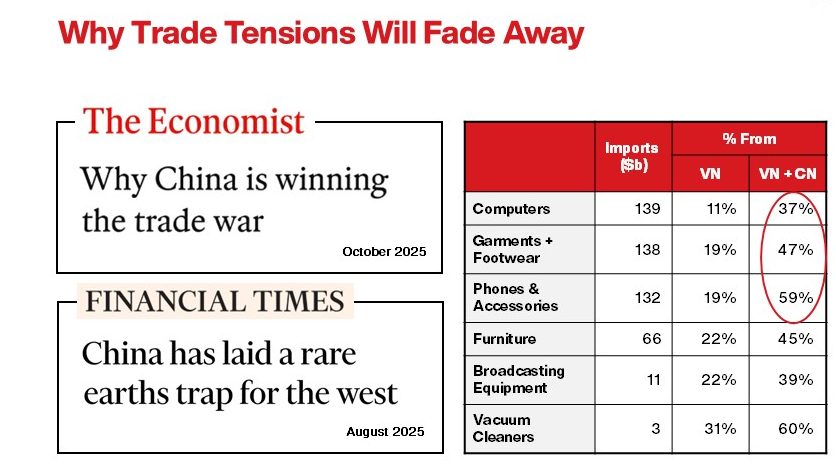

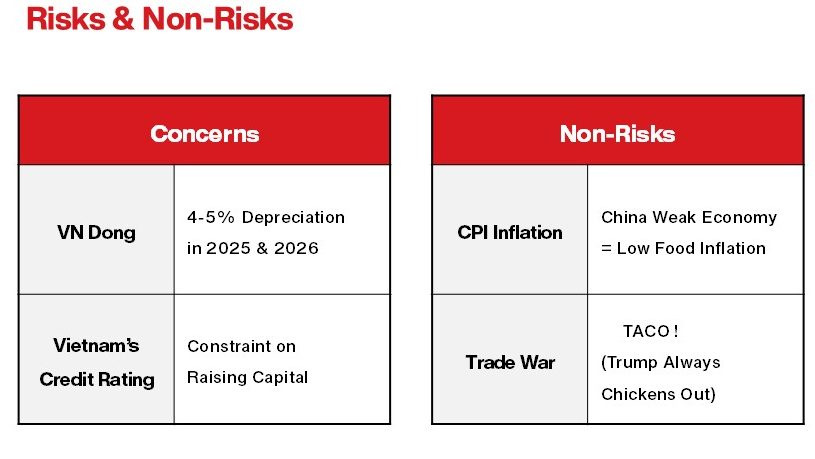

Tariff concerns abate. Another reason why Vietnam’s extraordinary export growth will moderate but remain resilient next year is that concerns about trade tariffs (which were a pressing theme in Q2 2025 following Trump’s tariff announcements in April) have subsided and are not expected to be a considerable risk in 2026. It has by now become clear that prolonged trade tensions can hurt key sectors of the U.S. economy (and Trump’s voting base), as made clear for example with China’s ability to withhold the supply of rare earths to the U.S., inputs that are essential to several key industries such as defense and electronics. As such, initial maximalist positions taken by Trump with the trade tariffs continue to be backed down from and reversed, given that prolonged trade tensions are expected to do more harm than good for the United States.

Domestic consumption a key 2026 growth driver. VinaCapital’s economics team estimates that Vietnam’s very strong export growth will likely add 2% pts to GDP this year, while muted domestic consumption will deduct circa 2% pts from this year’s GDP growth. Domestic consumption remained muted despite a plethora of pro-growth Government policies (including a VAT cut) and an increase in public infrastructure spending, both of which tend to support consumer confidence. In short, many households depleted their savings during COVID and have been saving at an extraordinarily high rate despite the fact that their incomes are currently growing at a pace of about 6-7%.

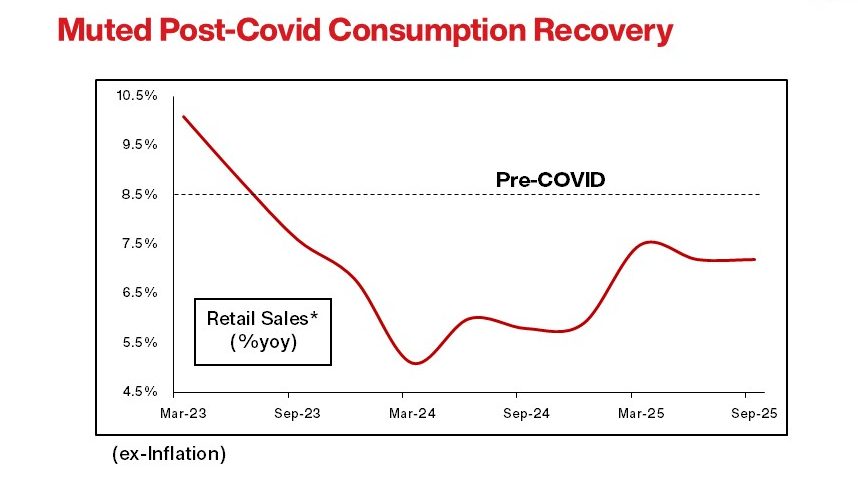

By mid-2026, household spending is expected to normalize. This savings dynamic helps explain why real retail sales growth in Vietnam (which is usually a close proxy for domestic consumption growth) never fully recovered to pre-COVID levels, as can be seen in the chart below. However, we believe that enough time will have elapsed by mid-2026 that Vietnamese households will resume spending at a normal pace. Furthermore, the positive sentiment impact of the Government’s pro-growth initiatives and public infrastructure spending on domestic consumption will be more strongly felt on Vietnam’s economy starting in 2026. Finally, ~USD 5bn in direct compensation to civil servants affected by the provincial mergers will also provide more disposable income for domestic consumption.

Real Retail Sales

Tourist arrivals effect on real retail sales. In addition to the points above, note that the arrival of foreign tourist arrivals – who we estimate account for around 10% of retail sales in Vietnam – are up over 20% y/y, which implies that spending by domestic Vietnamese consumers is currently only growing at about a 5% pace (versus 8–9% growth pre-COVID and versus the current 7% total rate of growth for real retail sales).

Infrastructure spending to stimulate the economy. Following the footsteps of other countries in East Asia such as Japan and China (both of which spent more than 10% of GDP on infrastructure development for about two decades), Vietnam aims to increase infrastructure investment from 6%/GDP this year to 10%/year going forward, with the Ministry of Finance projecting public investments of approximately USD 320bn over the next five years. Increased public infrastructure spending, coupled with faster progress on major projects like HCMC’s new airports or Hanoi’s new ring roads, would directly stimulate the economy and indirectly boost GDP growth by making consumers feel more confident to spend more money.

Real estate to benefit. As construction on flagship infrastructure projects like the new Long Thanh airport and expanded ring roads around major cities continue to advance, demand for real estate in new suburban townships and for workforce housing near industrial parks and logistics hubs should both increase. Fortuitously, the Government is now removing a number of bureaucratic issues that have stalled the development of real estate projects in the past, and now there are several real estate projects in advanced planning stages/receiving approvals to start construction in the upcoming months, all of which should also indirectly help boost consumer confidence.

Risk of VND depreciation. The monetary and fiscal policies Vietnam’s Government is currently pursuing, coupled with insufficient level of FX reserves, has weighed on the value of the VN Dong in 2025, so we expect a 4-5% depreciation of the USD-VND exchange rate in 2025 with a further comparable depreciation in 2026.

Inflation is not a significant risk. In contrast to the previous point, we do not see a real risk of higher inflation in Vietnam, because the variables that could spur inflation are very much under control by Vietnam’s policymakers. For example, Vietnam produces most of its food domestically (food accounts for nearly 40% of the CPI basket), and China’s moribund economy has also helped keep Vietnam food price inflation low. We expect Vietnam’s CPI to stay around 3-4% for the foreseeable future.

Sovereign credit rating upgrade. Vietnam’s BB+ sovereign credit rating – which is one notch below investment grade – could potentially constrain the country’s ability to raise the foreign capital needed to fund the country’s ambitious infrastructure development goals. This issue will not impact Vietnam’s immediate economic growth outlook but will need to be addressed over the next few years to achieve Vietnam’s aggressive infrastructure plans, which will need to be partially funded by foreign capital.

The role of AI in Vietnam’s future. Technological advancement is a key pillar of the Government’s growth agenda, and the topic of Artificial Intelligence repeatedly came up during the Conference. Vietnam’s deep STEM talent pool and globally connected diaspora have led to a situation in which Vietnam is “punching above its weight” in the field, with a disproportionate number of experts in the field from Vietnam (including the author of this year’s hottest AI book, “AI Engineering” by Chip Huyen, who grew up in rural Vietnam and studied computer science at Stanford). NVIDIA and Qualcomm recently acquired two leading AI firms in Vietnam and hopes are high that AI can help shift Vietnam from contract manufacturing to higher-value creation by building exportable software, embedded intelligence, and data-driven services that generate more value for Vietnam’s economy.

What Doi Moi 2.0 Means for Vietnam’s Stock Market

The transition of Vietnam’s GDP growth from being driven by external factors in 2025 to being driven by domestic factors in 2026 and beyond will be good for the stock market because firms listed on the exchange are highly exposed to domestic consumption, to credit growth, and to the local real estate market. Domestic driven growth will benefit local banks, consumer goods firms, real estate developers, and several sectors of the stock market (most of Vietnam’s exports are produced by FDI firms that are not listed on the stock market).

FTSE EM upgrade. The Government’s capital market reforms led to an announcement in early October by FTSE Russell that Vietnam will be reclassified from Frontier to Secondary Emerging Market Status, with an effective date on September 2026, which could potentially prompt USD 5-6bn in passive capital inflows to Vietnam. This upgrade reflects improved liquidity and regulatory reforms (e.g., facilitating more foreign participation), among several other benefits – and over time, MSCI and other indexes are likely to follow, further deepening Vietnam’s capital markets.

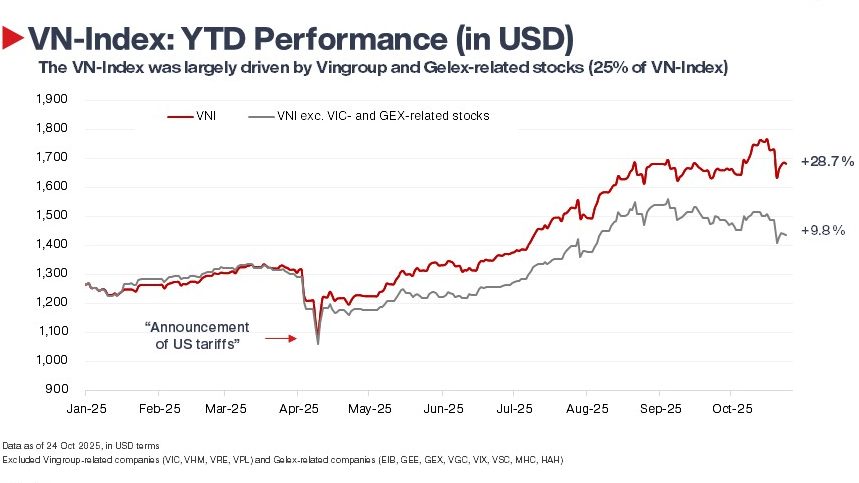

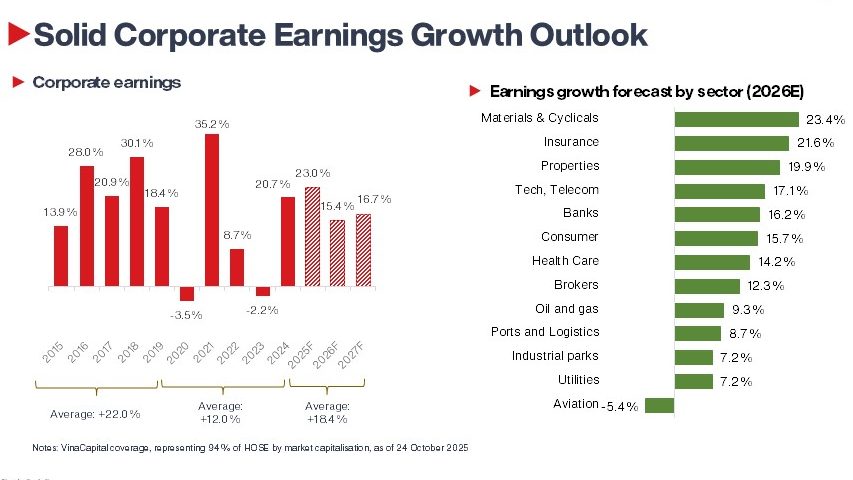

Stock market performance in 2025 and 2026 was discussed by Thu Nguyen, who runs VinaCapital’s mutual fund listed equity and fixed income business, and Linh Vu, Head of Research, both of whom highlighted the broad-based nature of the earnings growth we expect next year in their Stock Market Outlook Presentation. In 2025, the VN-Index has performed strongly, up ~30% YTD in USD terms, following a 18% dip in April after Trump’s tariff announcements. This strong performance was largely driven by a few real estate and industrial names: real estate rallied over 150% (driven by Vingroup affiliated stocks) while industrials surged by more than 40% (driven by Gelex group stocks), while many other sectors lagged despite sound fundamentals.

Stable earnings growth. We expect earnings growth to decelerate from ~23% in 2025 to 15-20% in 2026, as the extraordinary performance posted by a few conglomerates in 2025 normalizes. Next year’s top contributors to earnings growth should include banks, property, materials & cyclicals, and consumer companies. The ongoing increase in Government infrastructure spending and continued efforts to unfreeze the real estate market are both expected to support domestic consumer confidence and spending, which in turn should benefit local banks, which are especially exposed to real estate and domestic consumption.

Vietnam’s 2025 GDP growth is being flattered by extraordinary exports and tourism; 2026 should look more balanced as domestic demand, credit formation, and construction pick up as external drivers normalize. For the stock market, this rotation from external to internal engines matters. Earnings breadth should improve as banks, materials/cyclicals, selected consumer platforms, and real-estate adjacencies translate policy spend into activity and cash flows.

Furthermore, there has been a major lag between the Government’s infrastructure outlays (up 43% YoY) and construction activity (9% YoY); that gap is set to narrow next year, translating policy spend into real activity across banks, property, materials/cyclicals, and consumer spending. Note also that we expect bank lending to tilt towards higher-margin mortgages and project-finance tied to public works, which should support bank net interest margins (NIMs).

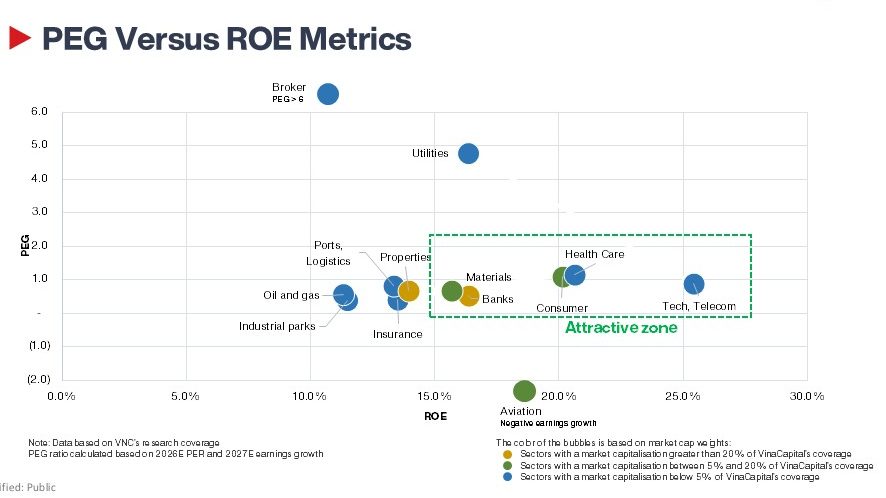

Supportive valuations. The forward P/E of the VN-Index sits near its long-run mean—hardly stretched, although there is a wide valuation dispersion under the surface, which creates entry points: several defensives/cyclicals (Industrials, Energy, Insurance, Consumer Staples, Utilities, Banks) trade at or below their five-year averages, while Real Estate and Brokers screen above. The PEG-vs-ROE map below reinforces where risk-adjusted value clusters: Banks, Materials/Cyclicals, Consumer, Health Care, and Tech/Telecom sit in the “attractive zone,” pairing double-digit ROEs with PEGs around ~1 or lower—i.e., growth priced sensibly. Net-net, with broad multiples anchored and leadership concentrated in high-ROE, low-PEG groups, we stay selective in pockets rich in PEG terms (e.g., Brokers, some Utilities/Real Estate) and lean into sectors best positioned for the 2026 domestic-demand handoff.

Increasing number of IPOs. The return of IPOs, after a quiet stretch that started in 2018, has begun, and the pipeline into 2030 spans financials, consumer, industrials, tech-enabled services, and select FDI-backed names. This should broaden sector representation beyond banks and real estate, deepen liquidity, and create new ways to express Vietnam’s domestic-demand and infrastructure themes. Vietnam’s capital market reforms are also a positive step towards strengthening the country’s financial foundation, and we expect more important reforms to follow in years to come.

Investing in Vietnam 2.0

VinaCapital’s Chief Investment Officer Alex Hambly framed the discussion on investing in Vietnam 2.0 with a key point: Vietnam’s private sector is the country’s key growth engine (again, noting the importance of Resolution 68), and the best opportunities cut across both listed and private markets. His emphasis was on disciplined, hands-on investing: do the hard channel checks and be willing to create opportunities rather than wait for them to appear. That posture underpins how our listed and private equity teams are positioning for 2026, and this is exactly where VinaCapital’s diversified platform pays off.

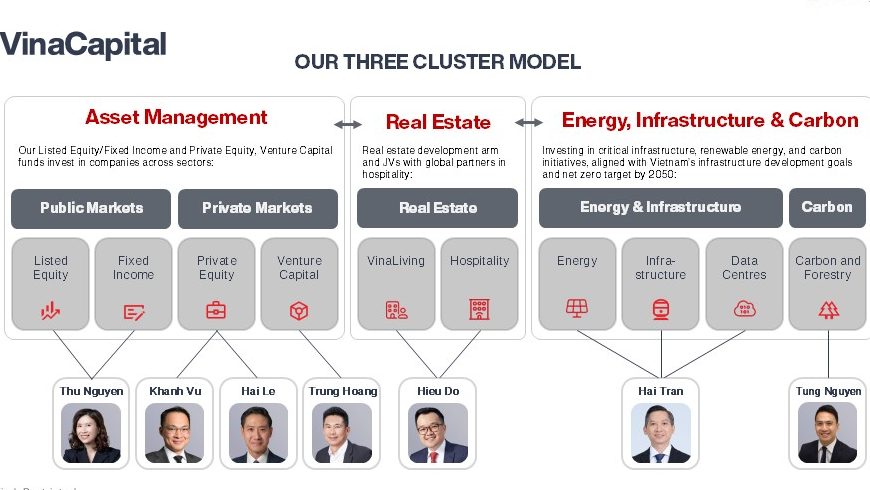

VinaCapital’s platform. Operating across listed equity, private equity, fixed income, real estate, venture, energy & infrastructure, and carbon gives us more solution paths for the same macro thesis, more proprietary deal flow, and better decisions via cross-silo insight sharing (for example, what our Infrastructure team learns on input costs and permitting feeds directly into listed Industrials and Materials underwriting). It also improves risk management—position sizing, hedges, and liquidity across vehicles, and helps us attract and retain specialist talent in each vertical.

The platform is organized around a three-cluster model:

- Asset Management spans public markets (listed equity, fixed income) and private markets (private equity, venture capital), allowing us to express a view across the capital stack.

- The Real Estate team develops projects and partners with global operators, creating investable themes in housing and hospitality that rhyme with the consumption and urbanization thesis.

- Energy, Infrastructure & Carbon deploy long-duration capital into critical assets—renewables, grid and transport links, data centers, and nature-based solutions—aligned with Vietnam’s growth targets and net-zero goals.

Listed equities strategy. Thu Nguyen, Deputy CEO of VinaCapital Fund Management, noted that 2025’s rally was unusually narrow, as previously discussed, and driven largely by a small group of conglomerates, leaving a broad opportunity set trading at attractive multiples. Ex-those outliers, market valuations compress to roughly ~10–11x forward P/E, while VinaCapital’s active portfolios (such as UCITS fund Forum One – VinaCapital Vietnam Fund) hold 25–26 high-conviction names with 2026 earnings growth in the high-teens and single-digit forward P/Es. Thu’s teams are staying bottom-up and valuation-disciplined, leaning into quality businesses with sustainable earnings, strong balance sheets, and capable management rather than chasing momentum. She highlighted three investable themes for 2026:

- Consumer stocks, where market-share gains and operating efficiencies are driving a margin expansion (e.g., modern trade taking share, retail formats scaling).

- Banks, which are benefiting from credit quota removal, a gradual real-estate thaw that lowers credit costs, and funding demand from public-works projects. Leading banks still trade around or below long-run P/B norms.

- Infrastructure-related companies (materials, contractors, and enablers) that benefit from the Government’s multi-year capex push. Thu also flagged risk markers to watch—currency and deposit-rate trajectories—while noting that governance and disclosure standards continue to improve and that the FTSE EM upgrade plus a returning IPO pipeline should broaden market depth.

Private equity playbook. Lead Portfolio Manager of VOF Khanh Vu described private equity as “the art of being active”: originate off-market deals, run rigorous channel checks, “panic early” when governance issues surface, and flexible capital use to accelerate operational upgrades. With Vietnam’s reform agenda catalyzing privatizations and listings, we see a rich opportunity set across consumer platforms, logistics and industrial services, and other scalable operating businesses—where value creation can come from both earnings growth and multiple expansion at exit. In short, the same edge that powers our listed strategy—high active share and deep local diligence—also defines our private equity playbook.

Energy and Infrastructure. Head of Energy & Infrastructure Hai Tran outlined how VinaCapital’s platform is positioned to take advantage of Vietnam’s power-market reforms and the country’s digital build-out. His team is focused on a variety of projects, including a utility-scale Direct Power Purchasing Agreement (DPPA) renewable energy platform targeting ~2GW of installed capacity by 2030 and Vietnam’s first hyperscale data center (60–80MW IT load, up to ~USD 2bn capex). The value proposition of these projects is local execution coupled with international standards with a focus on land acquisition, permitting and offtake agreement—precisely the bottlenecks that determine which megaprojects commission on time.

Real Estate. Head of Real Estate Hieu Do set the tone for how the company intends to convert today’s policy tailwinds into project cash flows. VinaLiving’s track record—20+ landmark developments and eight fully realized exits at a 49% gross USD IRR—gives us a repeatable playbook as approvals accelerate under new Land and Housing laws. The near-term focus is to capture upside along HCMC’s ring roads and highways via residential and hospitality co-investments, while maintaining the “global discipline + local insight” operating model that has differentiated returns through multiple cycles.

Logistics and Co-investments. Head of Logistics and Co-investment Hai Le discussed how our logistics strategy complements public capex by channelling private capital into core, immobile assets paired with operating platforms. Following our first investment in ALS Cargo Terminal at Noi Bai Airport in Hanoi, which serves blue-chip international carriers, we are widening the aperture from aviation into adjacent marine and land-based nodes with A.P. Moller Capital as our partner. The thesis is to underwrite infrastructure-like durability and enhance it with private-equity style value creation across terminals, ICDs, and warehousing (including cold-chain), a segment growing at mid-teen growth rates.

As has been done with logistics, our co-investment platform aims to partner with reputable international partners to co-invest in attractive private firms in Vietnam. The platform leverages VinaCapital’s network and investment track record across a number of practices to offer attractive investment opportunities to co-investors on equal terms. The platform extends its scope to all alternative asset classes within VinaCapital with the idea of offering VinaCapital’s selected deal pipeline to co-investors who are looking for opportunities in Vietnam on a deal-by-deal basis

Venture Capital. Trung Hoang, Head of Venture Capital, highlighted the role of venture capital in Vietnam’s “Doi Moi 2.0” story. Our VC platform is one of the few in Vietnam with multi-vintage cycles and realized distributions—53 investments across two funds, a fully exited first fund at 3.7x MOIC, and a second vintage tracking toward 1.2–1.7x TVPI—allowing us to back asset-light software and data-driven businesses that can scale across the region. Trung is raising a third vintage targeting technology companies in the growth segment of the capital stack, which aligns with the Government’s focus on technology, innovation, and digital transformation.

VinaCarbon. Tung Nguyen, Head of VinaCarbon, connected the dots from decarbonization to investable cash flows. The platform’s first deal—a partnership with Ba Che Forestry to upgrade ~3,000ha of state-owned plantations—illustrates how operational improvements (e.g., FSC standards, shift from wood chips to sawlogs) layer with carbon-credit monetization as Vietnam readies a compliance market later this decade. The strategy taps under-invested forest assets at scale and adds optionality via pellets, biochar, and eco-tourism, creating both economic and social value in remote provinces.

Platform synergies. Finally, Alex Hambly tied these verticals back to the platform’s three cluster approach by emphasizing that Vietnam’s policy shift toward private-sector–led growth and our ability to work across the full liquidity spectrum means opportunities can be captured in listed or private markets, via funds or co-investments. That breadth expands our sourcing lanes, improves risk management, and lets us match structure to the specific bottleneck a project or company must solve.

Company Presentations

Leaders of various corporations in Vietnam also shared positive views about Vietnam’s next phase of development, and provided insights on their growth strategies.

Techcombank. Recognized as a leading, highly profitable full-service bank in Vietnam, Techcombank is distinguished by its market-leading CASA ratio, strong capital base, and innovative digital platform which allows it to scale operations efficiently. Its success, according to CEO Jens Lottner, is driven by a strategy centered on attracting top talent, leveraging significant investments in digital transformation, and data management (from eight billion data points daily). The bank is strategically focused on the growing middle-income class, aiming to shift its loan book to favor the retail segment over the next five years, while maintaining superior asset quality.

Phu Nhuan Jewelry. CEO Thong Le discussed PNJ’s transformation from a production-focused, state-owned enterprise into a leading lifestyle retailer. His vision centers on betting on the growing demand for lifestyle products in Vietnam over the next 20 years. PNJ leveraged technology for rapid growth and to gain market share, even doubling its bottom line during the challenging COVID period. The company is seeing a divergence in consumer behavior: older customers focus on jewelry as a financial asset, while younger customers prioritize trendy designs and brands, which it addresses by moving to customized, differentiated product offerings for each segment and region.

Long Chau Pharmacy. COO of FPT Retail Quyen Nguyen highlighted the rapid and successful expansion of Long Chau Pharmacy, which has become the leading pharmacy chain in Vietnam, reaching 2,450 stores nationwide. She attributes this success to three keywords: trust, technology, and people. The business model is profitable due to the sustained growth of old stores alongside new openings, keeping the average revenue per store high. This efficiency is powered by technology that ensures “right medicine, right time, and right place” by maintaining an automated, highly accurate fulfilment and forecasting system.

Vinamilk. CMO Tri Nguyen presented Vinamilk as a national icon, established in 1976, that embodies Vietnamese pride and values. He emphasized the brand’s immense popularity, stating that nine out of ten Vietnamese households use at least one Vinamilk product. Vinamilk uses advanced technology across its entire supply chain to ensure product quality. He highlighted the company’s governance and vision, as it was one of the first state-owned companies to successfully privatize and remove its foreign ownership limit. Mr. Tri also noted the success of the new, immersive, and fun Vinamilk stores, which represent an incredible rebranding effort beyond traditional supermarket sales.

An Cuong Wood. Vietnam’s leading supplier of decorative woodworking materials is a long-term private investment of VinaCapital. The discussion showcased Le Van Anh, daughter of the founder and Director of Business Solutions, who represents the new generation driving growth and change. She detailed her efforts in digital transformation and continuous product innovation. The panel also addressed ESG, with strengthened corporate governance via An Cuong’s 2022 IPO, and the company’s commitment to becoming net zero by 2050 and its use of recycled wood as a core, naturally green material.

Keynote Speech

H.E. Nguyen Van Duoc, Chairman of the Ho Chi Minh City People’s Committee, framed his keynote around a simple idea: Vietnam has entered an era of “breakthrough and acceleration,” and HCMC intends to be the engine. He grounded that ambition in fundamentals—stable macroeconomics, a young and well-educated workforce, rising high-tech exports, and an alignment between the Government and the business community. The message for investors was straightforward: policy intent and operating reality are converging in HCMC, and the city is organizing itself to deliver faster approvals, faster execution, and faster growth.

The Chairman linked those themes to four national resolutions that underlie “Vietnam 2.0.

- Resolution 57 puts science, technology, innovation, and digital transformation at the center of growth.

- Resolution 66 upgrades the law-making and enforcement process, critical for clearing historic bottlenecks in land and project approvals.

- Resolution 59 deepens international integration.

- Resolution 68 elevates the private sector as the primary growth engine.

Ho Chi Minh City’s role in Vietnam 2.0. HCMC’s task is to translate these into local action: implement special mechanisms, streamline permitting, and push decision-making closer to the ground so that time-to-shovel drops materially. Currently, HCMC’s 2025 gross regional domestic product (GRDP) is about USD 115bn, or nearly one-quarter of the national economy, with per-capita GRDP of nearly USD 9,000—around 1.7x the national average, and the city generates roughly 37% of the country’s national budget revenue.

Furthermore, HCMC already processes a disproportionate share of the country’s commerce and fiscal flows, making policy improvements here disproportionately impactful for Vietnam’s aggregate growth and for corporate earnings tied to urban consumption, logistics, finance, and producer services.

Strategic breakthroughs will center on three objectives:

- Policy and regulatory reforms to unblock projects—especially around construction and land—paired with piloting greater urban autonomy to reduce “last-mile” frictions.

- Infrastructure development that improves regional connectivity via urban rail and port systems, accelerates urban renewal, and backs “smart/green” transport solutions that lower logistics costs over time.

- Human-capital development that upgrades education and training, introduces mechanisms to attract and retain talent, builds a practical R&D/startup ecosystem, and installs a public KPI system so execution can be measured and managed.

Investment implications. Backlogs in land and project approvals are set to ease which should pull private capital into transport, utilities, and housing development near new transportation corridors, and a nascent service ecosystem is expected to flourish around the city’s new international financial center. Strengthened corridors in HCMC’s city–port–industrial-park triangle should boost the throughput of logistics operators, consumer and healthcare demand should follow increased employment, and the city’s human-capital push should deepen the white-collar base needed for finance, software, and advanced manufacturing. In short, HCMC is not merely signaling ambition—it is codifying a playbook that, if executed, can translate into higher velocity for construction, employment, and earnings across listed and private market opportunities.

Conclusion

Vietnam is undertaking Doi Moi 2.0: an ambitious reform agenda that includes parallel pushes in science and technology, stronger capital markets, internal Government reforms with a view to increased efficiency, and an upgrading of Vietnam’s private sector to “the most important driving force” for the country’s economic growth. These reforms aim for a rebalancing of Vietnam’s economic growth drivers towards domestic driven factors, and we believe the reforms could add 2%pts to the country’s long-term GDP growth.

In the short term, GDP growth in 2025 has been flattered by extraordinary high export and tourism arrival growth. GDP growth in 2026 should look more balanced as domestic demand, credit formation, and construction do more of the work as external drivers normalize. This rotation from external to internal engines matters for the stock market. Earnings breadth should improve as banks, materials/cyclicals, selected consumer platforms, and real-estate adjacencies translate policy spend into activity and cash flows. In addition, the outsized contribution from a handful of conglomerates this year should normalize next year.

VinaCapital’s role—and opportunity set—sits squarely in this transition. Our listed-equity portfolios maintain high active shares in quality businesses with durable mid-teens earnings power at sensible valuations; our private equity, logistics, real estate, and energy/infrastructure platforms are positioned to convert public capex and regulatory reform into investable cash flows; and our venture and carbon strategies extend that flywheel into productivity and sustainability. Net-net, we see a constructive medium-term setup—policy tailwinds, reasonable valuations, and an expanding opportunity set—tempered by the usual EM watch items (currency risk and execution on project objectives).