As of this writing, the USD-VND exchange rate has depreciated 4.5% YTD, a level at which the State Bank of Vietnam (SBV) has in the past taken concrete action to support the Dong. The value of the VN Dong has never depreciated by more than 3.5% in any calendar year since 2015, even in years when the currencies of Vietnam’s regional EM peers suffered much larger depreciations (the FX rates of Vietnam’s regional EM peers have depreciated between 4.1% YTD for Malaysia to 8.5% for Thailand in 2024). The relative resilience of the VND helped earn the SBV’s Governor an A+ rating from Global Finance Magazine last year1and reflects the central bank’s intensified resolve to stabilize Vietnam’s currency following the major devaluation of China’s currency in 2015.

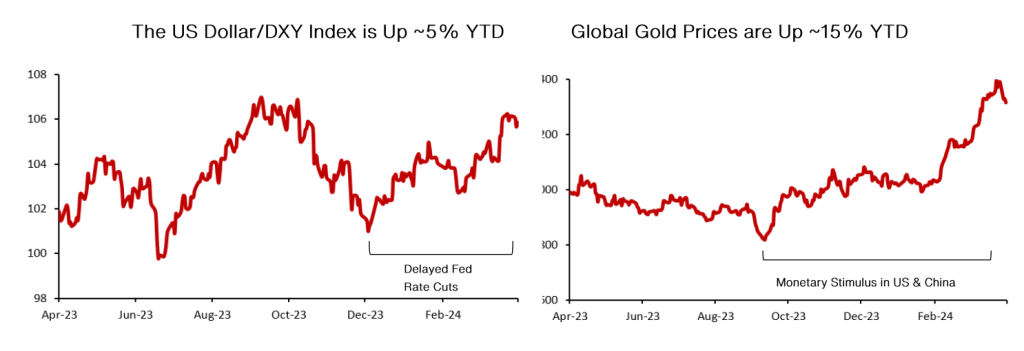

This year, the drop in the value of the VND has been driven by a few factors, including the unexpected strength of the US Dollar, which is up nearly 5% YTD (for the DXY Index) because hotter-than-expected US inflation and economic growth is reducing the number of times that the Fed is likely to cut US interest rates in 2024. In addition, gold prices have risen by as much as 16% YTD (and by 30% since late-2022), which is also putting pressure on the USD-VND exchange rate because Vietnamese investors are enthusiastic buyers of gold, and their gold purchases ultimately entail the sale of VN Dong / purchase of US Dollars.

Consequently, the VN Dong is simultaneously facing depreciation pressures from both a strong US Dollar (driven by higher USD interest rates) and from the bull market in gold. This is an unusual situation because higher US interest rates support the value of the US Dollar, but typically lead to lower gold prices by increasing savers’ “opportunity costs” of holding gold in lieu of depositing the money in the bank. Given the array of depreciation pressures aligned against the VN Dong2, and the likelihood that inflation in Vietnam will reach 4-5% by year-end (thanks in part of rising oil prices), we expect bank deposit rates in Vietnam will be 50-100bps higher by year-end in order to stem the depreciation of the VND.

We do not believe interest rates need to increase by much more than 100bps to support the USD-VND exchange rate because Vietnam’s trade surplus widened from 6% of GDP in 2023 to 8% of GDP in 1Q24, and FDI disbursements are robust at around 5% of Q1 GDP. Also, Vietnamese policy makers are balancing between stabilizing the value of the VN Dong and fostering economic growth, which means that interest rates need to be high enough to support the Dong, but not so high that tight monetary policy impedes GDP growth.

That said, in recent years (especially in 2022) the SBV demonstrated that it is willing to sacrifice some growth to achieve a stable USD-VND exchange rate – presumably because FX rate stability encourages FDI investment, which in-turn supports Vietnam’s long-term economic growth.

Supporting the VN Dong

Vietnam’s central bank used several tools over the last two years to stem the depreciation of the VN Dong, including:

- The sale of the SBV’s US Dollar FX reserves to the country’s commercial banks

- “Cancellable FX forwards”

- Policy interest rate hikes, and/or

- Draining liquidity out of the money market to boost short-term interbank interest rates.

Further to #1 above, the SBV’s FX reserves peaked at USD110 billion in 2021 according to SBV officials quoted in the local business press; at present, those reserves are thought to be between USD90-100 billion, or around three months’ worth of imports, which is considered the minimum safe amount of FX reserves for every country’s central bank to keep on hand. Consequently, we do not expect a dramatic drawdown in Vietnam’s reserves from current levels.

Also, the SBV offered to sell USD to local banks at a USD-VND exchange rate of 25,450 (a 4.9% YTD depreciation), but in our understanding, the Vietnamese banking system currently has an ample amount of US Dollars (i.e., banks are long Dollars), so banks only bought a negligible amount of USD from the SBV this week.

Further to #2 above, in the past the SBV entered into “cancellable FX forward” transactions with local commercial banks that gave those banks the option to purchase dollars at a USD-VND exchange rate comparable to the prevailing rate at the time the contract was agreed/entered into. In other words, the SBV’s cancellable FX forwards are essentially put options on the VN Dong that the SBV gives away to commercial banks for free with the aim of cooling commercial banks’ concerns about the possibility of a plunging VN Dong.

Interest Rates and the VN Dong

In addition to direct interventions into the FX market (i.e., buying or selling USD), central banks around the world typically use interest rates to defend the value of their countries’ currencies. Vietnam has a complex array of policy interest rates, but what ultimately matters vis-à-vis the value of the Dong is the actual interest rates at which banks transact amongst each other in the interbank market and the deposit interest rates they offer to savers (the latter is what matters for the country’s stock market and real estate market). Consequently, we do not expect the SBV to formally hike policy interest rates to protect the value of the VND (as it did in 2022), but rather to continue focusing on interbank interest rates as it has in recent weeks.

From March 11th to April 19th, the SBV sold USD8.3b of T-Bills to Vietnam’s commercial banks, which lifted the short-term interbank (overnight) interest rate from 0.7% to 4%, bringing it in-line with Vietnam’s re-financing policy interest rate, which is currently 4.5%. This week, the SBV lifted the 14-day reverse repo rate by 25bps to 4.25%, presumably in an effort to nudge interbank interest rates higher. Higher VN Dong interest rates incentivize commercial banks to hold on to their VN Dong and discourages so-called “carry trades” that entail banks borrowing VN Dong at low interest rates in order to exchange that money into high-yielding USD deposits.

Finally, the protracted drop-in Vietnam bank deposit rates that started in March 2023 is now over. Some banks recently raised the interest rates they pay savers, and we believe that deposit rates will need to be about 50-100bps higher by the end of the year to make it less attractive for local savers to buy gold (which does not earn interest) or to buy US Dollars in order to speculate on the USD-VND exchange rate.

More on the Strong USD and Gold Bull Market

Last week, US Fed Chair Jerome Powell said that the battle against inflation in the US was taking “longer than expected,” prompting some to speculate3 that the Fed will not cut interest rates at all in 2024. That’s a dramatic turnaround from the beginning of the year when the consensus expected six Fed cuts in 2024 starting from March. Furthermore, Powell’s comments, as well as those from other Fed officials, stand in stark contrast to the European Central Bank’s guidance two weeks ago that it will likely begin cutting Euro interest rates in June.

The confluence of hawkish guidance from Fed officials, stronger-than-expected US retail sales figures (for both February and March) and escalating Middle East tensions helped lift the USD-JPY exchange rate to above the psychologically important ‘155’ level for the first time in more than 34 years and drove a near 2% depreciation in the USD-VND exchange rate last week alone. In response to the strong US Dollar, the governments of Korea, Japan, and the US issued a joint statement on currency stability. Meanwhile, Indonesia’s central bank hiked policy interest rates by 25bps and the State Bank of Vietnam offered to sell USD to the country’s commercial banks as discussed above.

Finally, escalating geopolitical tensions help explain why gold and the USD are rallying contemporaneously. But central bank buying (including by the central banks of China and countries in the Middle East) is the main factor driving up the value of gold, as are concerns that governments around the world (especially in the US) are likely to print money to service their enormous debt burdens (the UK government bond crisis in late-2022 launched the current gold bull market).

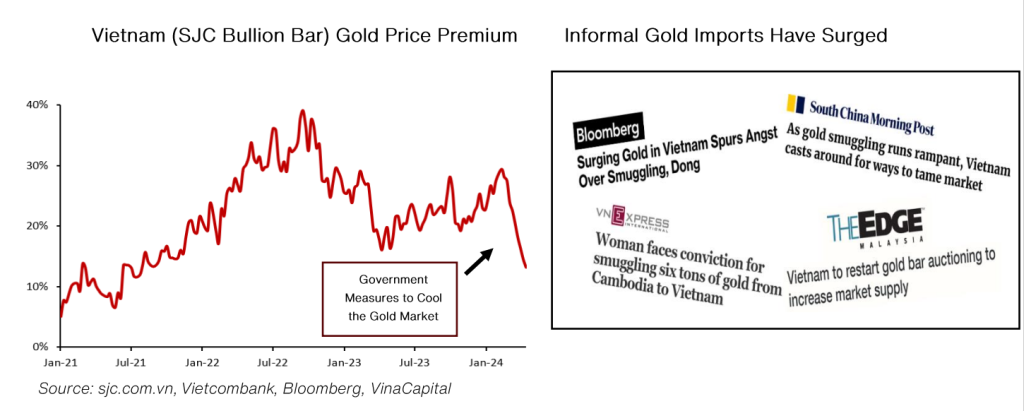

Gold Market Measures

Vietnam’s Government has limited gold imports for more than a decade, resulting in the price of officially sanctioned gold bullion bars issued by state-owned Saigon Jewelry Company (SJC) consistently trading at a significant premium to world gold prices. The SJC gold bar price premium has recently widened to extreme levels, as can be seen in the chart below on the left, driven by enthusiasm among local investors to participate in the ongoing global bull market in gold prices. In turn, Vietnam’s gold price premium prompted informal gold imports over the country’s long border with Cambodia, a topic which has been discussed in the press recently, as can be seen below right.

Informal gold imports ultimately drain USD out of the country, which is recorded as “errors & omissions” in Vietnam’s balance of payments accounts (Vietnam’s errors & omissions were around 4%/GDP in 2023, according to the SBV). The SBV recently announced that it would auction off some of its gold (which are a part of Vietnam’s FX reserves) and signaled that it could resume official gold imports to Vietnam for the first time in 11 years. These announcements, together with certain other, less impactful measures, helped reduce the SJC gold price premium back to the circa 15% level (which is still fairly high, by historical standards).

We are sympathetic to the SBV’s dilemma. The quantity of gold it would need to import in order to reduce the Vietnam gold price premium would be significant and could have an adverse impact on FX reserves. However, when the price of gold in Vietnam is significantly higher than world gold prices, it encourages informal gold imports which indirectly drains Dollars from Vietnam’s economy.

Investment Implications of VND Depreciation

We mentioned above that the depreciation of the VN Dong is likely to lead to a circa 100bp increase of bank deposit rates in Vietnam by the end of the year. Higher deposit rates improve the attractiveness of putting money in the bank rather than in the stock market. Higher deposit rates also lead to high lending rates / higher costs capital for companies, which depresses corporate profits. Consequently, higher interest rates are usually bad for the stock market.

However, the current depreciation pressure on the VN Dong – which is putting upward pressure on VND interest rates – is primarily attributable to US economic strength, and the strong US economy is boosting Vietnam’s exports and GDP growth. For that reason, we are not overly concerned that a 100bp increase in deposit rates in Vietnam will have a major impact on the country’s economy, on earnings growth (we still expect circa 20% earnings growth in 2024), and/or on the stock market this year.

Furthermore, the imminent rise in Vietnamese interest rates is actually supporting the nascent recovery in Vietnam’s real estate market by prompting potential home buyers to purchase properties promptly in order to lock-in the current level of borrowing rates. Most mortgages in Vietnam are 15-year floating rate loans, but it is currently possible to lock in interest rates as low as 6% for the first two years of the loan (or 7% for the first three years), and most prospective home buyers do not expect those low interest rates to last for much longer.

Finally, we also note the growing recognition that “higher for longer” US interest rates may currently be bolstering – rather than dampening – the US economy4. This paradox stems from the fact that savers in the US (especially “Baby Boomers”) are earning significant interest income on their savings for the first time in years, and they are spending that windfall income. Consequently, higher US interest rates are a double-edge sword for Vietnam; depreciation pressures on the VND are putting upward pressure on Vietnamese interest rates, but the strong US economy is also driving a recovery in Vietnam’s exports to the US from a 21% yoy drop in 1Q23 to a 26% surge in 1Q24.

Conclusions

The USD-VND exchange rate depreciated by more than 4% YTD, a level at which the State Bank of Vietnam has typically taken concrete actions to strengthen the VN Dong (the maximum VND depreciation over the last eight calendar years was 3.5%). The depreciation of the Dong has been driven by the unexpectedly strong US Dollar and by gold purchases by local savers, although Vietnam’s strong trade surplus and FDI inflows have supported the value of the VN Dong.

We expect deposit interest rates in Vietnam, which have plunged since early-2023, to rebound by 50-100bps by the end of the year. That magnitude of increase is not likely to have a major impact on the stock market, but we expect purchasers of real estate to act quickly to lock in the current low level of mortgage rates, adding fuel to Vietnam’s nascent real estate rebound./.