The US economy is by far the most important factor impacting Vietnam’s GDP this year. Vietnam is one of the three countries in the world that has the closest economic links to the US, and surprisingly strong US consumption is driving recoveries in Vietnam’s exports, manufacturing, and GDP growth. This report explains some of the details of that close linkage in response to many questions we recently received about this topic, especially given: 1) the upcoming US presidential election, and 2) the slowing US economy, which will likely lead the Fed to cut interest rates in September.

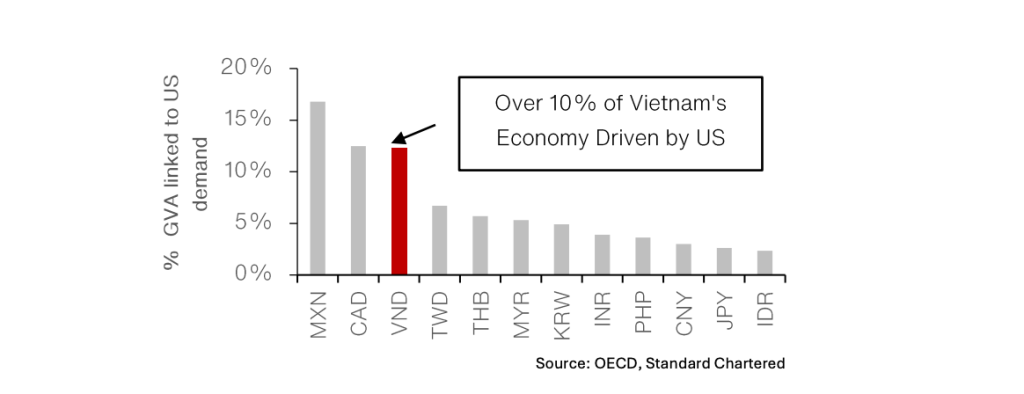

The short answer to #1 is that it probably won’t matter much to Vietnam which party wins in November because there are more similarities than differences between the policies of the Democrats and Republicans. Regarding #2, US consumption has remained remarkably resilient this year despite record-rapid Fed rate hikes (by 525 bps during 2022-23), because of the so-called “K-Shaped” economic dynamic in the US, which is explained below. That resilience is disproportionately benefitting Vietnam because economic developments in the US impact Vietnam’s economy more than any country in the world (other than Canada and Mexico), according to the OECD’s Inter-Country Input-Output (ICIO) analysis.

Strong demand for “Made in Vietnam” products from US consumers drove a rebound in Vietnam’s exports to the US from a 21% yoy drop in 7M23 to a 24% surge in 7M24, driving a recovery in manufacturing activity from 3.6% yoy growth in 2023 to 10% expected growth in 2024 (manufacturing grew 9.5% in 7M24). Manufacturing accounts for one-quarter of Vietnam’s economy, so the manufacturing recovery – which is being entirely driven by exports to the US – is likely to lift Vietnam’s GDP growth from 5.1% in 2023 to 6.5% in 2024 (GDP grew 6.4% yoy in 1H24). In contrast, the growth of real retail sales (i.e., stripping out the impact of inflation), which is a proxy for domestic consumption, halved from 10% in 7M23 to 5% in 7M24.

The “K-Shaped” US Economy and What to Expect in 2025

Vietnam’s economy is being supported by the “K-Shaped” economic dynamic in the US this year. The Fed hiked US interest rates to cool inflation, but instead of cooling the US economy, higher interest rates have been fueling increased spending by rich consumers in the US, who are represented by the upper part of the “K” in the “K-Shaped” economy. Those consumers are now earning much higher investment income on their savings and spending their newfound “windfall income,” including on “Made in Vietnam” products.

However, the consumption of lower middle-income consumers, who are represented by the bottom part of the “K,” recently started collapsing because the wages of these workers, who live “paycheck to paycheck,” are not keeping pace with inflation and because “poorer US consumers are running out of money” according to Dollar General, a leading retailer that targets low-income US consumers (the company’s share price sold off 30% after it issued that warning).

Consequently, we expect US consumer demand for “Made in Vietnam” products to flatten out (but not collapse) in early-2025, at which point we are optimistic that recoveries in Vietnam’s real estate sector (discussed in this report) and infrastructure investment will help drive GDP growth. Further to that last point, Vietnam’s Government recently raised its 2024 GDP growth target from 6.5% to 7%, illustrating policy makers’ resolve to maintain Vietnam’s strong economic growth. The two main levers it has at its disposal to speed up GDP growth in the short term are: 1) increasing the number of new real estate project approvals in Vietnam, and 2) ramping up infrastructure spending.

The US Election and Vietnam

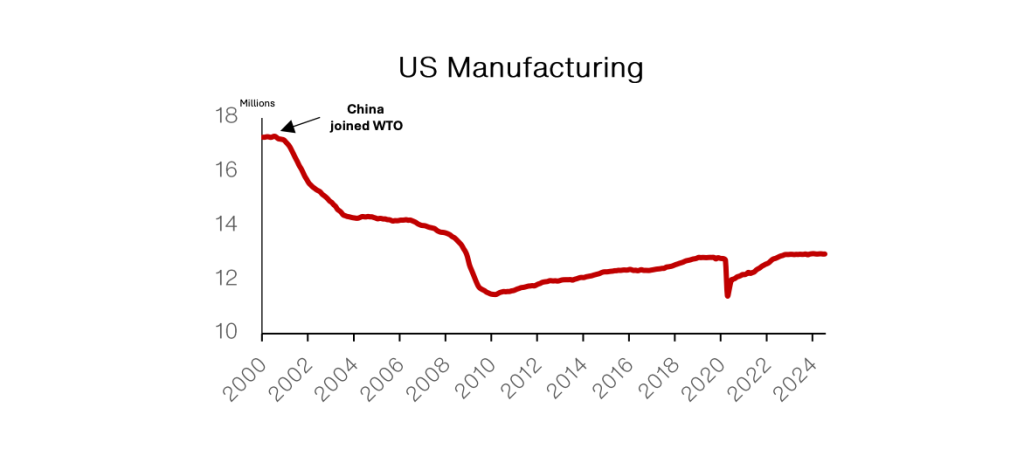

Politicians on both sides of the US political spectrum want to repatriate US manufacturing jobs, which collapsed after China joined the WTO. Populist Republicans favor imposing tariffs to reduce the competitiveness of imports (especially from China), while Democrats tend to favor an “industrial policy” approach, including subsidizing the development of domestic industries, although the Democrats have recently been warming up to protectionist policies.

Both approaches have problems. For example, Biden’s 2022 “CHIPS” act is a major industrial policy initiative that aims to boost tech manufacturing in the US; it drove a 4x surge in the amount of money being spent in the US to construct new factories. However, the cost of manufacturing products in the US is high and the number of high-skilled manufacturing workers in the US is low, so re-shoring is not likely to be a serious threat to the types of products made in Vietnam.

Trump reportedly wants to raise tariffs on US imports from China to 60%, and to impose 10-20% blanket tariffs on imports from other countries. But Trump and his running mate JD Vance also asserted that the US Dollar is overvalued, which is an impediment to “re-shoring” manufacturing jobs. Imposing tariffs boosts the value of the USD, so a Trump administration would need to choose between imposing tariffs and taking measures to weaken the value of the Dollar.

If elected, we would expect Trump to focus on weakening the USD instead of significantly increasing tariffs, despite his repeated avowals otherwise. Increasing tariffs would increase inflation in the US, and a weaker USD would also help the US government deal with a variety of other issues, including its astronomical debt.

Regarding the impact of all of this on Vietnam: 1) a weaker USD would boost Vietnam’s exports to countries besides the US, 2) a 10-20% blanket tariff on imports from countries other than China would not reduce Vietnam’s relative competitiveness vis-à-vis its competitors, and 3) if the US were to impose 60% tariffs on China, then Vietnam and Mexico would once again enjoy the biggest bumps to their exports, according to Standard Chartered and others.

Finally, we do not believe it will matter much to Vietnam who wins the US Presidential election. Geopolitical realities make it in the US’s own interest to strengthen economic ties with Vietnam, and the positions of Democrats and Republicans vis-à-vis trade with China have become very similar. Treasury Secretary Janet Yellen and National Security Advisor Jake Sullivan both recently publicly embraced some of Trump’s key populist economic policies, including tariffs on China,12 so we expect similar policies towards China and Vietnam irrespective of who is elected in November (Biden kept Trump’s China tariffs in place, despite being very critical of those tariffs during his 2020 presidential campaign).

Conclusion

The US economy is the single-biggest factor impacting Vietnam’s economy in 2024. That said, the boost Vietnam’s economy is getting from the US “K-Shaped” economy dynamic is likely to temper somewhat next year, although we are optimistic that the nascent recovery in Vietnam’s real estate market will take over as an important growth driver next year by boosting both economic activity and consumer sentiment/spending. Finally, Vietnam’s export prospects to the US will remain strong whoever wins the US Presidential race because of geopolitical realities and the similarities of the trade policies of Democrats and Republicans in the US./.