In 2023, Vietnam’s exports fell for the first time since the Global Financial Crisis (GFC), which weighed heavily on the country’s 2023 GDP growth; exports averaged nearly 90% of GDP over 2019-22. Exports resumed growth in Q4, and surged 42% yoy in January, supported by a 33% leap in high-tech products, which account for one-third of the country’s total exports.

The high January growth rates were boosted the low base set by a drop in Vietnam’s exports in early-2023 (exports fell 12% in 1Q23), as well as by the timing of the Tet Lunar New Year holiday, which is discussed below. But January export growth was impressive, even when considering the timing of the Tet holiday and/or last year’s drop in Vietnam’s exports (for example, exports grew by a vigorous 6.7% month-on-month in January 2024). More importantly, we expect Vietnam’s export recovery to continue gaining momentum in the months ahead.

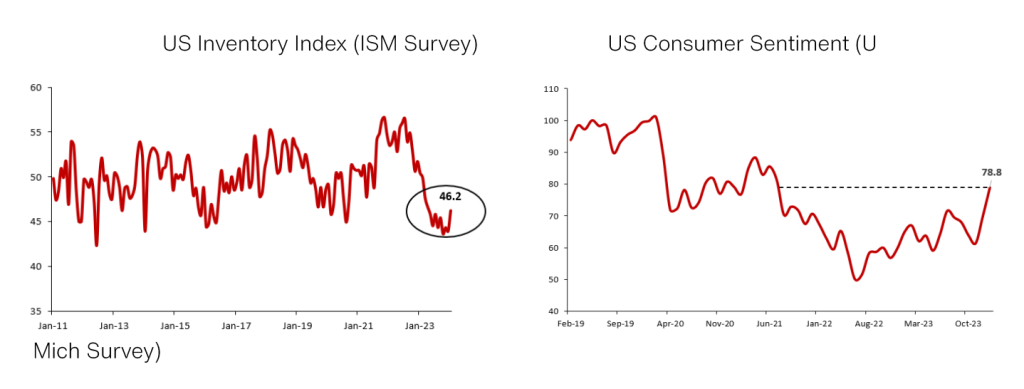

As we have noted previously, US firms over-ordered “Made in Vietnam” products during the COVID supply-chain disruptions and then subsequently slashed their purchases of such products last year so that they could reduce their bloated inventories. However, followingthe most aggressive pace of inventory destocking in over 10 years, that trend is now coming to an end, as can be seen in the chart above left.

Consequently, Vietnam’s new export orders resumed growth in January. A similar dynamic is seen in China, where new orders also improved considerably last month (although they continue to fall, albeit at a slower pace). We expect Vietnam’s new export orders to continue to increase in the months ahead due to the surprising strength of the US economy, as evidenced by the highest level of US consumer confidence since the COVID re-opening boom (which can be seen in the chart above right).

Export Performance Boosted by Tech and Tet

Vietnam’s strong January export growth was driven by a near 60% yoy increase in computer and electronics exports. Global PC sales plunged by 30% yoy in early 2023 but resumed growth late last year, partly driven by users upgrading to more powerful, AI-capable machines. Global smartphone sales also returned to growth in late-2023 for the first time in two years, although the ongoing rebound is less pronounced than for laptop computers in the absence of compelling new phone features prompting users to upgrade. Vietnam’s smartphone exports grew 16% yoy in January, driven by the introduction of Samsung’s new S24 smartphone during the month.

Finally, another reason that Vietnam’s exports surged in January was the fact that there were more than 25% additional business days in January 2024 than in January 2023 because Tet was on January 21-27 last year versus in February this year. A simple “back of the envelope” calculation suggests that exports should have grown by around 25% in January 2024 based solely on the number of additional business days, so that 42% surge in exports in January was impressive even accounting for the timing of the Tet holiday.

Supporting the Economy

Manufacturing output grew 19.3% yoy in January, so export growth far outstripped manufacturing growth, which means that manufacturers’ inventories of finished products fell last month (Vietnam’s January PMI survey also confirmed that decline in finished product inventories). The combination of falling inventories and growing new orders means production in Vietnam’s factories will need to increase in order to meet the increasing demand for “Made in Vietnam” products.

Manufacturing accounts for nearly 25% of Vietnam’s GDP, so faster manufacturing output growth would meaningfully boost GDP growth. In addition, nearly 10% of Vietnam’s workforce are employed by FDI companies in relatively high paying jobs. FDI companies laid off workers in early-2023, which is one reason that the country’s GDP fell to just 3.3% in Q1, but manufacturing employment has already fully recovered from last year’s layoffs, according to Vietnam’s General Statistics Office (GSO). Factory wage growth is recovering back to 5-7%, in our understanding, after having bottomed out last year.

Consequently, the economy is likely to get a boost from both an increase in manufacturing output and higher consumption this year, supported by an increase in manufacturing employment. Consumer confidence and domestic consumption, which were weak in 2023 based on layoffs and troubles in the real estate sector, is coming back. While we do not expect a robust increase in consumer spending in the first quarter, we do expect stronger consumer spending and domestic consumption as the year unfolds.

Supporting the Stock Market

We expect domestic investors to pour more money into Vietnam’s equity markets in Q1 and throughout the year because:

- Bank deposit rates in Vietnam are near all-time lows,

- The broad-based economic recovery discussed above should boost corporate earnings – especially for banks and consumer companies, and

- Valuations are incredibly cheap (the VN-Index is trading at a 10x FY24 P/E, nearly two standard deviations below its five-year mean valuation, and 25% below the valuation of its regional EM Peers).

Furthermore, the recovery in Vietnam’s real estate market will take more time to gather momentum because measures are just now being put in place1 to resolve the project approval issues that have been impeding development in recent years. The stock market is the most attractive place for domestic savers to place their money in the near term. That said, not all stocks will be winners and some companies do not have favourable earnings prospects. Our portfolio managers and research analysts are focused on finding companies whose earnings are growing over 20% and note that many of these companies are currently trading at incredibly low valuations.

Conclusions

The recovery in Vietnam’s exports that began in Q4 2023 gained momentum in January, driven by a renewed demand for high-tech products. We expect manufacturing activity to accelerate as 2024 progresses. Furthermore, employment in the manufacturing sector has now fully recovered from last year’s layoffs, so consumption is likely to be boosted by additional factory hiring in the months ahead.

The resulting broad-based economic recovery (in exports, manufacturing, and consumption) should boost the earnings in a range of listed stocks, enabling active managers like VinaCapital to outperform the broader stock market (for example, we expect the earnings of listed consumer companies to bounce from a 33% decline in 2023 to a 50% surge in 2024 and for listed banks’ earnings growth to jump from 6% to 18%).

Our local and offshore funds typically own around 25 securities and have an active share2 of over 65%, meaning that our investment managers are willing to depart far from the broader market indices to achieve outperformance. That willingness enabled our VinaCapital-VESAF and VinaCapital-VEOF equity funds to maintain their #1 and #2 market rankings over the past three years, returned 18.2% p.a. and 13.8% p.a. respectively. Both funds significantly outperformed the VN-Index (with a 3-year annualized return of only 0.8% p.a.)3./.