The VN-Index is up ~10% YTD driven by an expected 19% increase in FY2024 earnings, and strong buying of Vietnamese stocks by local retail investors – in contrast to heavy foreign selling this year. The rebound in earnings growth from a 5% drop last year to 19% growth this year is supported by an acceleration in Vietnam’s GDP growth from 5.1% in 2023 to an expected 6.5% in 2024. The enthusiasm of local investors to buy stocks stems from the facts that deposit rates in Vietnam are still below 5% – even for 12-month deposits – and that the country’s real estate market is still somewhat frozen, making the stock market and gold the preferred places for local investors to pour their savings.

Further to that last point, retail investors dominate stock market trading in Vietnam, accounting for 90% of daily trading value on average this year, so purchases by retail investors completely absorbed an estimated USD2.4b worth of Vietnamese stocks that foreign investors sold this year YTD (following USD1b of sales last year). Foreign investor selling was prompted by profit taking, by concerns about the circa 4% YTD depreciation of the VN Dong, and because some foreign investors are taking a “wait and see” approach towards investing in Vietnam in light of recent political developments in the country.

One-quarter of foreign selling transpired via ETF redemptions, including the dissolution of Blackrock’s iShares Frontier ETF which was liquidated in June1 (monthly foreign net sales of Vietnamese stocks hit a record-high in June, driven in part by the liquidation of this ETF). In the aftermath of that foreign selling, the proportion of Vietnam’s stock market owned by foreign investors fell to its lowest level in a decade.

However, we understand that selling linked to the liquidation of that ETF has now finished, and some sophisticated foreign investors have been taking advantage of foreign selling to increase their long-term strategic investments in Vietnam. For example, Capital Group, Fidelity, and other foreign institutional investors reportedly bought a large stake in ACB, Vietnam’s leading retail lender, earlier this year.

Positive Outlook for H2 and 2025

We expect earnings growth to accelerate from an estimated 9% yoy in 1H24 to 33% in 2H24, driven in part by the nascent recovery in the country’s real estate market. We published this report about the initial thawing occurring in Vietnam’s real estate market in December 2023, and the ongoing recovery has gained considerable momentum since then. We estimate that real estate transaction activity surged by about 40% yoy in 1H24 (up from 25% yoy in Q1), driven by pent-up demand and a series of laws to revive the market recently enacted by the Government.

Consequently, we expect the earnings of real estate developers (excluding Vinhomes, which is discussed below) to surge 80% this year. Furthermore, a healthier real estate market should support banks earnings’ by boosting credit growth and reducing asset quality concerns/credit costs. Finally, the recovery of Vietnam’s real estate sector is likely to further accelerate next year, which is one reason that we expect VNI earnings to grow by another 17% in 2025.

Wide Performance Dispersion

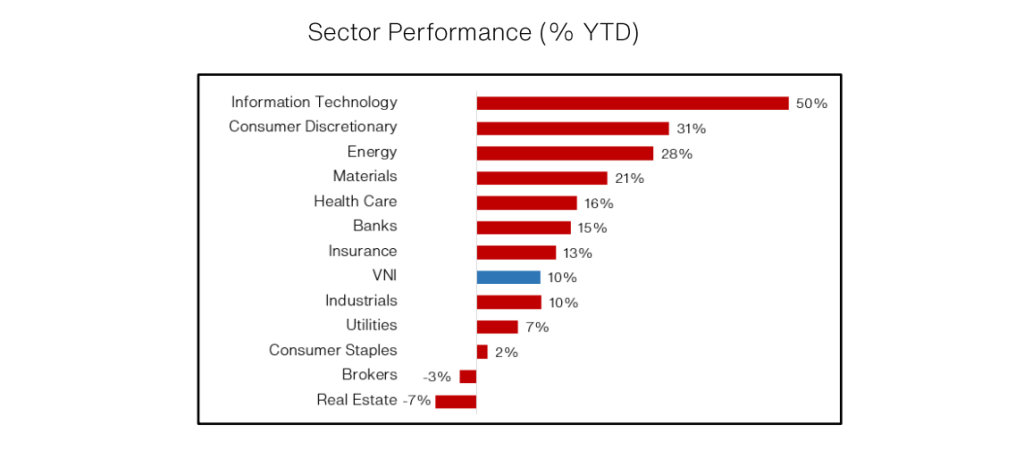

The wide variation in the performance of the sectors in Vietnam’s stock market seen below is typical and presents ample opportunities for active managers like VinaCapital to outperform the broader market (our local equity fund VINACAPITAL-VMEEF has outperformed the VN-Index by ~20% YTD). For example, our funds are overweight the IT sector, which is being buoyed by the global enthusiasm for AI-related stocks and by market leader FPT’s impressive earnings growth.

We expect FPT’s earnings to grow by over 20% this year, driven by a 24% increase in global IT outsourcing revenues. The company’s share price is up 53% YTD and 103% over the last two years – but the stock had been up as much as 180% (over two years) before foreign investors took profits in the name (FPT is one of the stocks that experienced the most foreign selling this year – as have stocks with a heavy weighting in the ETF’s).

Consumer discretionary stock prices have also performed well this year because the earnings of those companies are expected to grow 55% this year, after having dropped by 42% last year. That rebound stems from the fact that domestic consumption (excluding foreign tourists) was very weak in 2023 (when the sluggish real estate market and layoffs at FDI factories weighed heavily on Vietnamese consumer spending) but has recovered this year.

Similar idiosyncratic factors explain the performance dispersion among other sectors. For example, the earnings of Vietnam’s largest real estate develop Vinhomes look set to drop 12% this year because of the timing of when the company recognized revenues on certain projects. That drop, coupled with other factors, has driven a 14% YTD drop in the company’s stock price which in-turn has dragged down the whole sector.

Risks and Non-Risks

The value of the VN Dong has depreciated by approximately 4% YTD, prompting the State Bank of Vietnam (SBV) to sell an estimated USD6b of its FX reserves this year to defend the Dong. The strong US Dollar had been the main factor weighing on the value of the VND, but a strong USD is currently disadvantageous to the US Government for a variety of reasons, so the US Treasury Department has been using “Active Treasury Issuance (ATI)” and other tools to stem the appreciation of the US Dollar.2 Consequently, the likelihood of further VND depreciation has been reduced, although Vietnam’s FX reserves are now well below three months’ worth of imports which is usually considered the minimum prudent level.

Next, foreign investors have been paying closer attention to recent political developments in Vietnam and are especially focused on assessing how Vietnam’s leadership will continue the country’s pro-growth policies. We believe that no matter who ends up occupying the country’s key leadership positions, Government policy is likely to remain focused on attracting FDI and boosting the country’s economic growth. These policies have been remarkably consistent over the past twenty-five years, and we firmly believe that they will continue to drive growth and development for years to come.

Conclusion

The VN-Index is up ~10% YTD, driven by an earnings growth recovery and by purchases by local retail investors. Sector performance has varied considerably this year, enabling active managers like VinaCapital to outperform the market. We are cognizant of the risk of further VN Dong depreciation. We also believe Vietnam’s pro-growth policies will continue to drive the country’s development for years to come, irrespective of who holds the key positions in the Government./.